Base Layer Virtualisation - What does that mean for THORChain?

A new chapter begins for @RujiraNetwork and @THORChain : the Base Layer Virtualisation Strategy is live, with the first quotes now active in the TCY/BTC BTC/USDT, ETH/USDT and XRP/USDC markets on RUJI Trade.

Behind the technical jargon is a simple goal: making swaps atomic to deliver an unmatched user experience to the traders. 🔁

Let’s dive in ⤵️

❓The Problem

THORChain’s Base Layer is unmatched in enabling native cross-chain swaps. But there’s one catch: swaps only settle at the end of each block.

For apps built on top, that means they can’t run truly atomic transactions combining Base Layer swaps with other App Layer actions.

👉In other words, you can’t within the same block do something on the App Layer, trigger a Base Layer swap, and then continue with another App Layer action using the proceeds.

Without atomicity, the App Layer still functions, but it can’t reach its full potential, leaving builders limited in what they can create.

💡The Solution : Base Layer Virtualisation

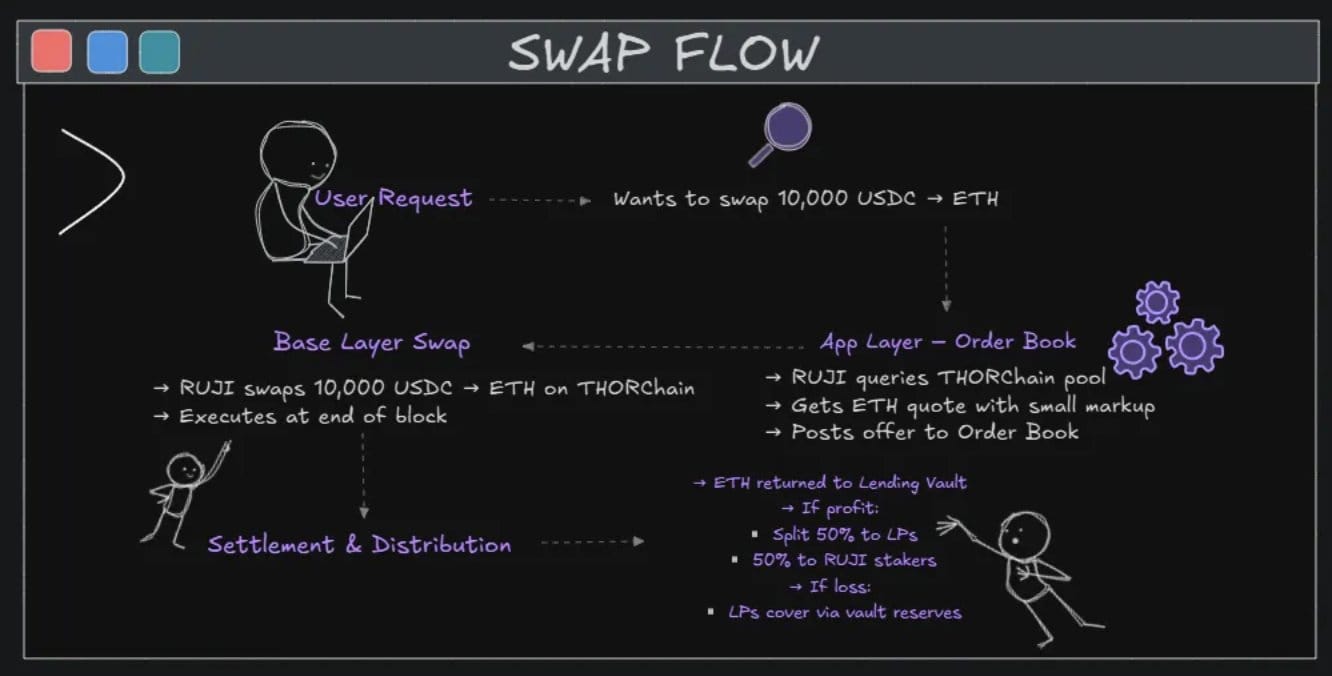

Virtualisation solves this by making the whole flow of actions atomic, so it behaves as if it all happened at once. Here’s how it works in practice:Imagine you want to swap 10,000 USDC for BTC on RUJI Trade.

1️⃣ The App Layer checks how much BTC the Base Layer would return for 10,000 USDC.

2️⃣ It offers you a quote at nearly the same price (Base Layer price + small margin).

3️⃣ To fill your order instantly, the App Layer borrows BTC for one block from RUJI Lending and delivers it to you.

4️⃣ At the end of that block, the App Layer uses your 10,000 USDC to swap for BTC in THORChain’s pools.

5️⃣ In the next block, it repays the borrowed BTC and shares any profit with LPs and RUJI stakers.

👉From your perspective, the trade feels instant and atomic. In reality, the App Layer is virtualising the Base Layer liquidity to make it possible.

Now imagine this at scale, thousands of trades and actions being processed in parallel, all settling within a single block. Virtualisation makes this possible and allows the App Layer to scale seamlessly on top of THORChain.

⚡️Impact on the Base Layer

The Base Layer Virtualisation ultimately routes every trade back into THORChain’s pools. This means more volume, more fees, and greater utility flowing to the Base Layer. 💰

Liquidity that once only served native swaps will now also power actions on the App Layer, increasing its usage and further cementing THORChain’s position in DeFi.

🗺️What’s Next?

The TCY/BTC, BTC/USDT, ETH/USDT and XRP/USDC pairs are only the beginning. Over the coming weeks, more pairs will be virtualised, starting with smaller quote sizes until audits are complete. After that, limits will be raised, unlocking much larger volumes.

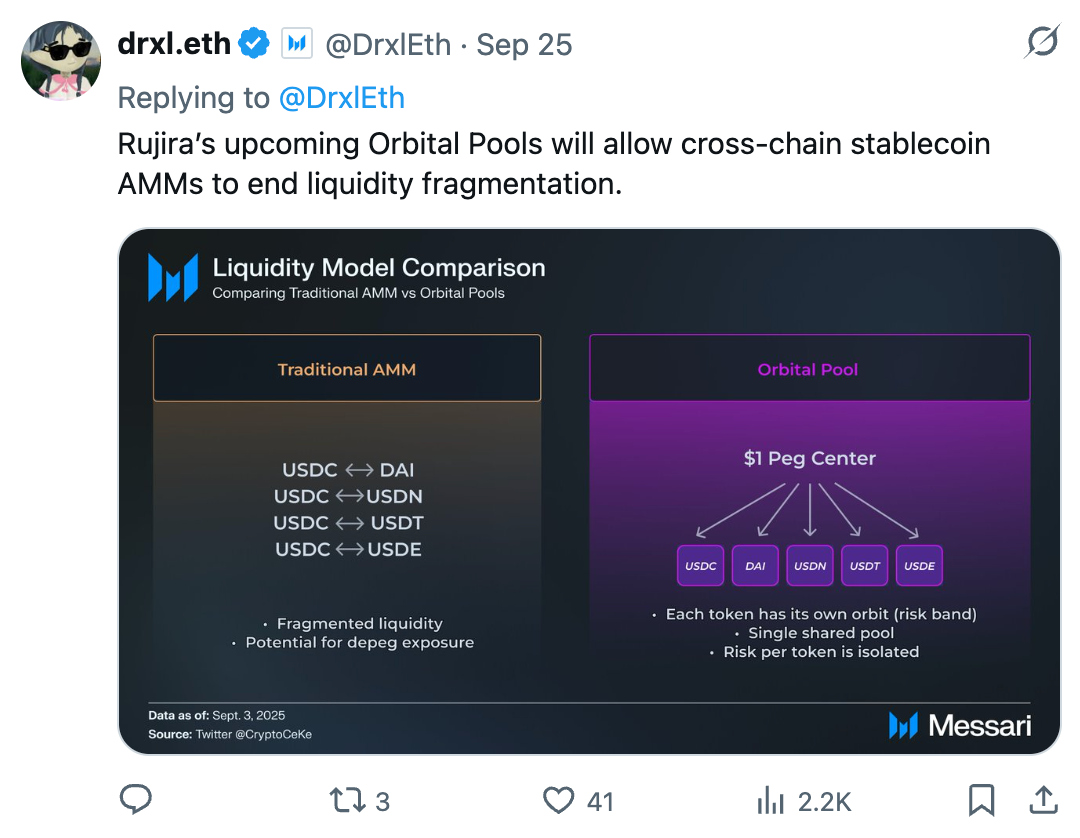

On top of this, new features are coming soon on the App Layer such as Orbital Pools, concentrated liquidity for better pricing and smart routing integrations.

👉Together, these upgrades will drive higher volumes and make THORChain the backbone of a truly decentralised, omnichain trading experience.

Rujira is steadily gaining momentum, and with these promising features combined with THORChain’s upgrades, activity is set to accelerate significantly in the weeks and months ahead.

Onwards ⚡️