Calc Finance - Redefining DCA Strategies

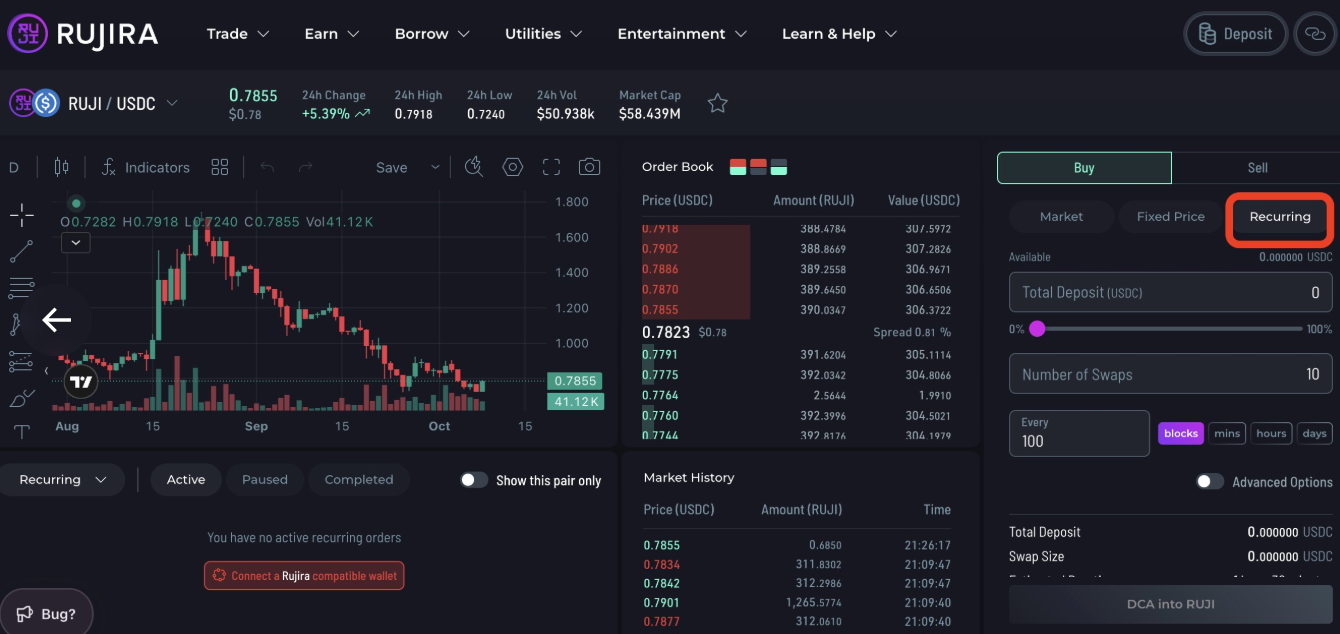

@CALC_Finance isn’t just another swap tool. Built on @RujiraNetwork, it takes a familiar concept, dollar-cost averaging, and pushes it a step further with smarter, rules-based strategies designed to help users accumulate crypto with less stress and more efficiency.

👉At the heart of its approach is DCA+, an upgrade on traditional dollar-cost averaging that adjusts allocation dynamically to market conditions.

But Calc’s ambitions don’t stop there. The protocol is laying the groundwork for a wider toolkit of strategies that can serve both everyday investors and institutional treasuries.

Let's dive in ⤵️

🐣The Origin

The story of Calc began after the Terra-Luna collapse, when the Kujira team launched a new blockchain and inspired a wave of builders to create practical tools for users.

It was in this environment that Calc Finance was born, with a simple mission: help people invest smarter, take emotions out of trading, and avoid getting rekt.

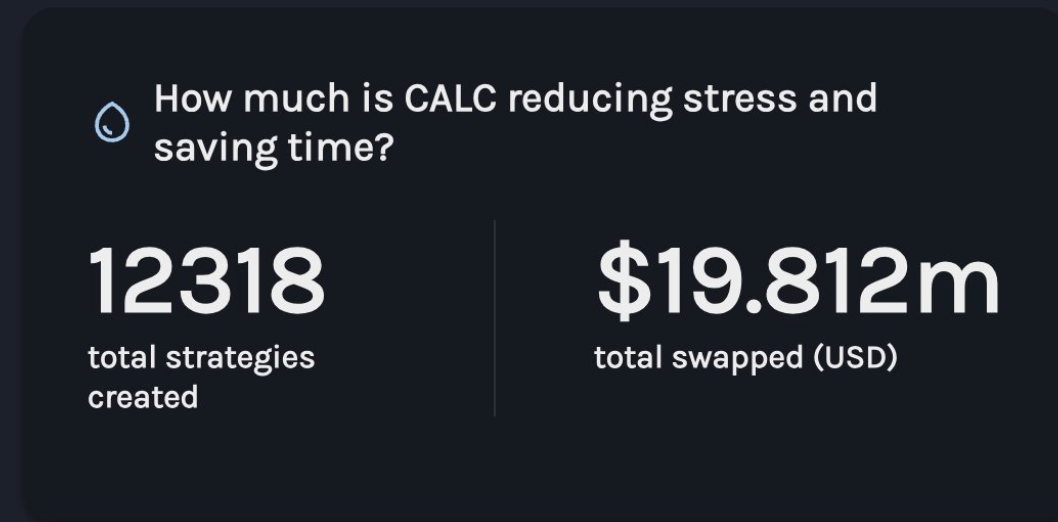

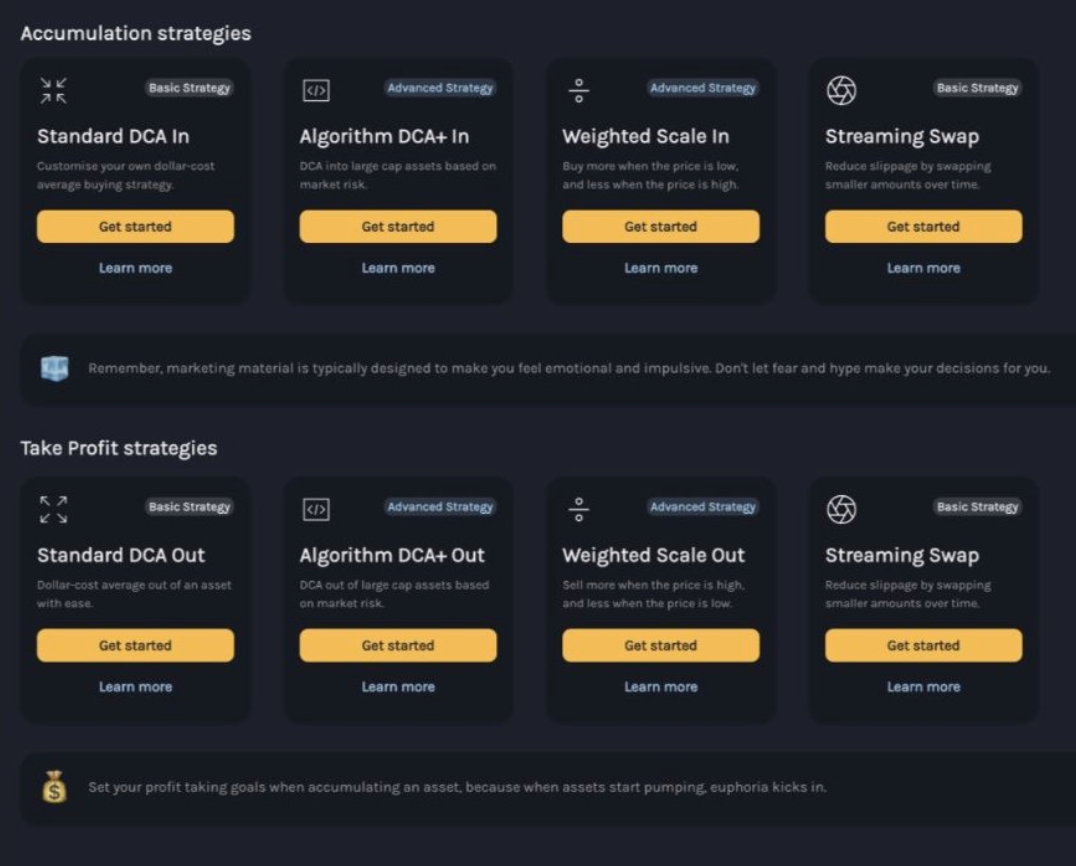

The first version of Calc launched in 2023 on Kujira and quickly took off. What started as a basic DCA tool expanded into more advanced strategies like Algorithmic DCA+, Weighted Scale, and Streaming Swaps.

Over time, thousands of strategies were executed through Calc, moving tens of millions of dollars across blockchains including Kujira, Osmosis, Archway, and Neutron (with Astroport integration).

This track record set the stage for Calc’s arrival in the THORChain ecosystem, where it is now bringing its experience in structured accumulation to an even broader audience.

🧠Smarter Accumulation with DCA+

Dollar-cost averaging has always been one of the most popular ways to enter volatile markets. By spreading purchases over time, it reduces timing risk. But it traditionally treats all conditions equally, buying the same amount whether the market is calm or overheated.

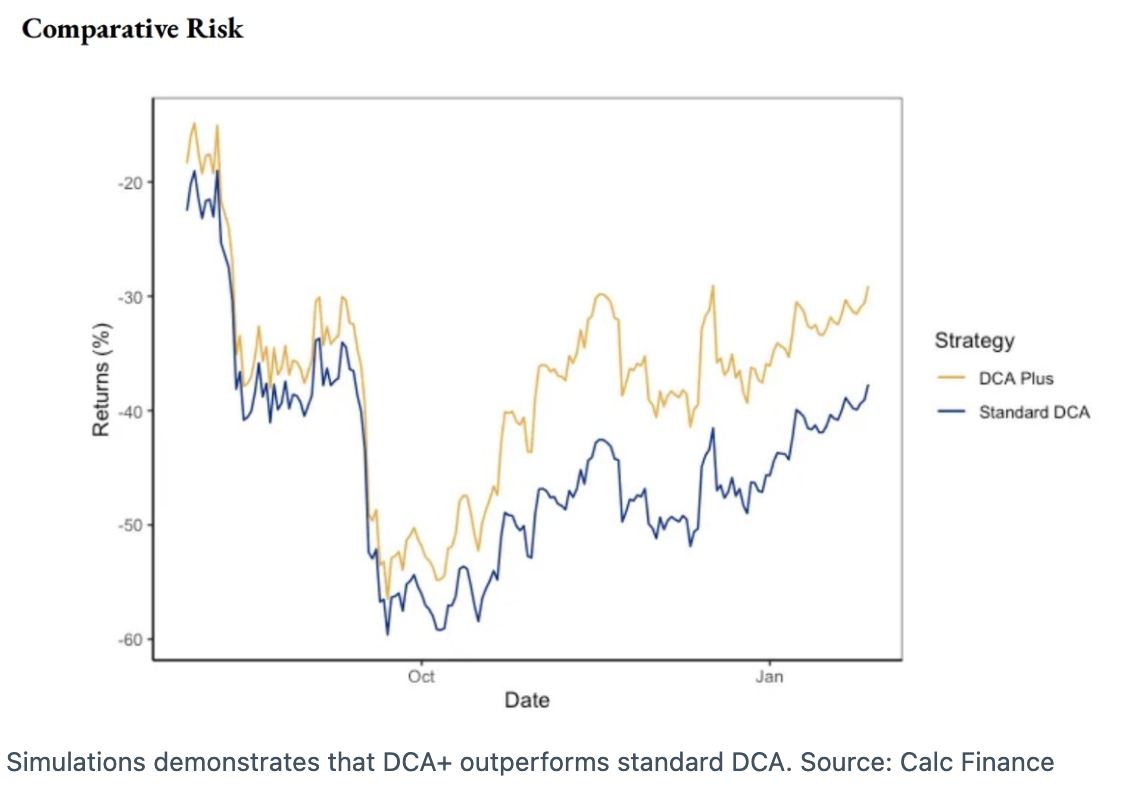

👉Calc’s DCA+ addresses this limitation by introducing a risk-adjusted approach.

Instead of making every purchase the same size, it scales allocations based on market conditions. When risk is lower, the strategy increases purchase size. When volatility rises, it reduces exposure.

The result is a strategy that keeps the defensive nature of DCA, but uses market context to improve efficiency. Although not immune to negative market cycles, DCA+ consistently produced better accumulation outcomes with slightly lower drawdowns compared to a fixed DCA approach based on a backtesting simulation.

👉For users, the takeaway is simple: invest more when conditions are right, and step back when they aren’t.

🗺️Beyond DCA+, What’s Next

While DCA+ remains the flagship product, Calc’s upcoming V2 release makes clear that this is only the beginning.

👉The update expands the protocol beyond a single accumulation strategy, introducing new recurring swap mechanisms, greater flexibility in how allocations are structured, and post-swap tools such as automated staking.

With these additions, Calc positions itself not just as a tool for risk-adjusted accumulation, but as a broader framework for systematic investing and portfolio management on the THORChain App Layer.

🪙A Fair Economic Model

Calc Finance uses a performance-based fee model, aligning revenue with user success and proving confidence in its product.

Users aren’t charged for simply participating or executing swaps. Instead, a fee is only taken when DCA+ outperforms a traditional DCA benchmark. To do so, a portion of assets is held in escrow during the strategy, and the correct fee is deducted only at the end.

This way, protocol revenue is tied directly to positive outcomes, while costs remain limited for the users if the strategy does not deliver an advantage.

👉This model aligns Calc’s success with its users’ success: the protocol only earns when the strategy delivers better results.

💭Calc is Boosting DeFi capabilities.

Calc Finance illustrates how DeFi can move beyond simple swaps toward structured, rules-based strategies that help people accumulate wealth over time. By combining the familiarity of DCA with the intelligence of dynamic allocation, it creates a pathway for investors to participate in volatile markets with more confidence and less emotion.

For retail users, it’s a way to invest smarter. For institutions, it’s a framework for systematic exposure. And for the ecosystem, it’s another example of how the App Layer can expand the range of what’s possible on THORChain.

👉 Calc has already proven its model across multiple chains. Now, with the launch of DCA+ on the App Layer and more strategies on the horizon, the only question is how far this team of builders can take their vision.

– – – – – – – – – – – – – – – – –

– Stay updated on THORChain –

– – – – – – – – – – – – – – – – –

Swap now 👉 swap.thorchain.org

Official website 👉 https://thorchain.org/

🔽 Follow THORChain 🔽

X / Linkedin / Reddit

TikTok /IG / FB / Blog

🔽 Join the community 🔽

TG / Discord / Discord (DEV)

– – – – – – – – – – – – – – – – –