Credit Accounts: Rujira Expanding DeFi on THORChain

Rujira has already demonstrated that it can build serious DeFi infrastructure. Spot trading is live, perpetuals are live, and trading strategies are already being deployed on top of its stack.

But a DeFi ecosystem built only around trading is incomplete. Lending is what unlocks capital efficiency, leverage, and a broader range of financial activity. Without it, DeFi remains fragmented and limited in what users and developers can actually do.

With Credit Accounts, Rujira introduces native, trust-minimised lending on top of THORChain. Instead of relying on wrappers, bridges, or custodial platforms, lending is built directly on THORChain’s security model.

Here is how it works. 👇

1️⃣ Credit Accounts Explained

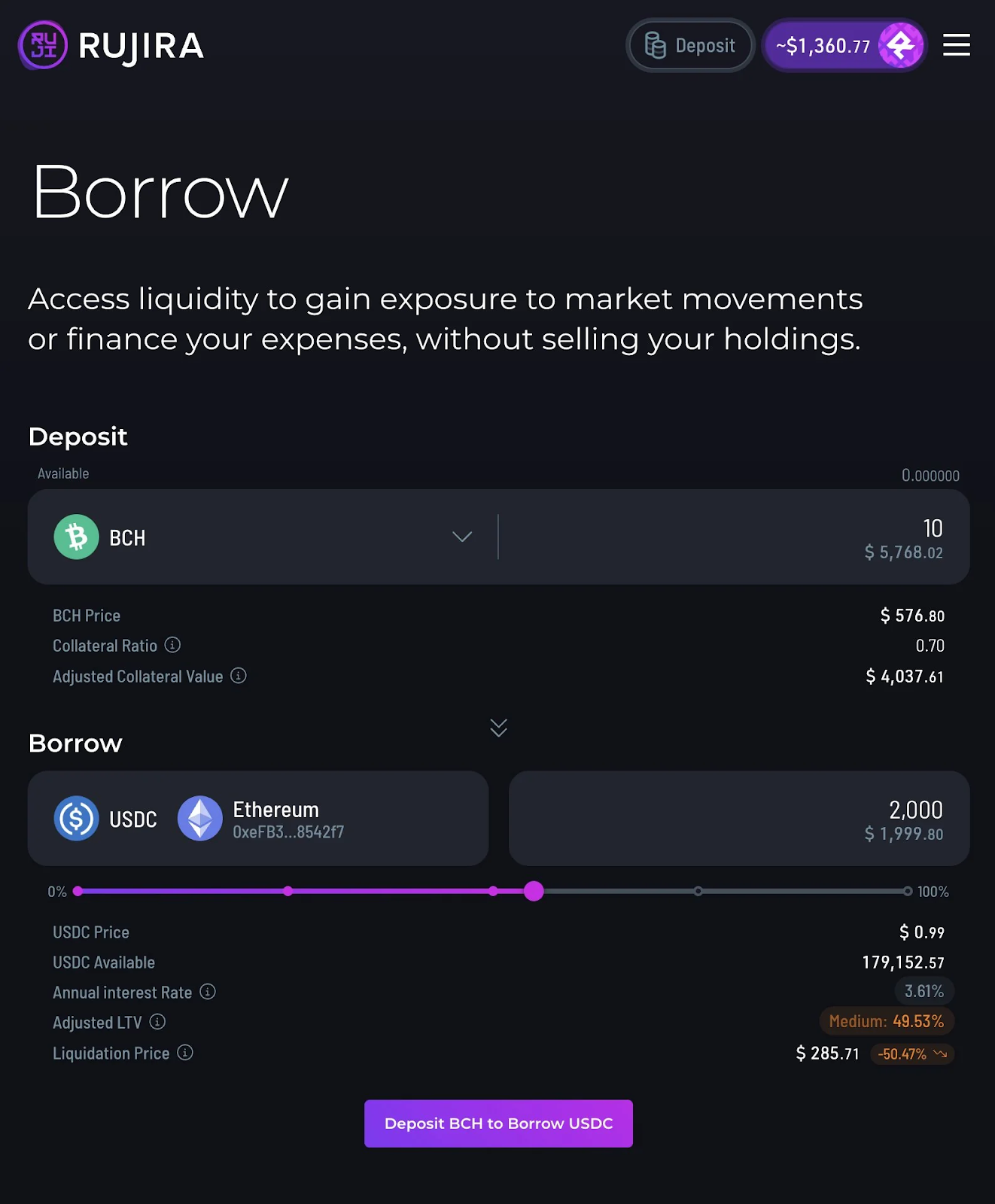

A credit account is a borrowing position backed by collateral. You deposit assets, borrow against their value, and deploy the borrowed funds however you choose. Your original assets remain locked as collateral and can be reclaimed once the debt is repaid.

This model is not new. It exists in traditional finance, centralised exchanges and DeFi through margin accounts, credit lines, and collateralised loans.

In most DeFi lending systems, borrowing requires users to move assets to a single execution chain, typically Ethereum. This usually involves bridging assets, minting wrapped tokens, and relying on governance-controlled smart contracts.

Each step introduces additional trust assumptions and risk, from centralisation of control to bridge failures and wrapped assets losing their peg.

👉 THORChain takes a different path.

With credit accounts on THORChain, assets remain native and positions remain fully onchain. There are no wrapped tokens issued on another chain, no custodians, and no trusted intermediaries. Control stays with the user, while security is enforced by the protocol itself through its node network.

👉 This is made possible through Secured Assets.

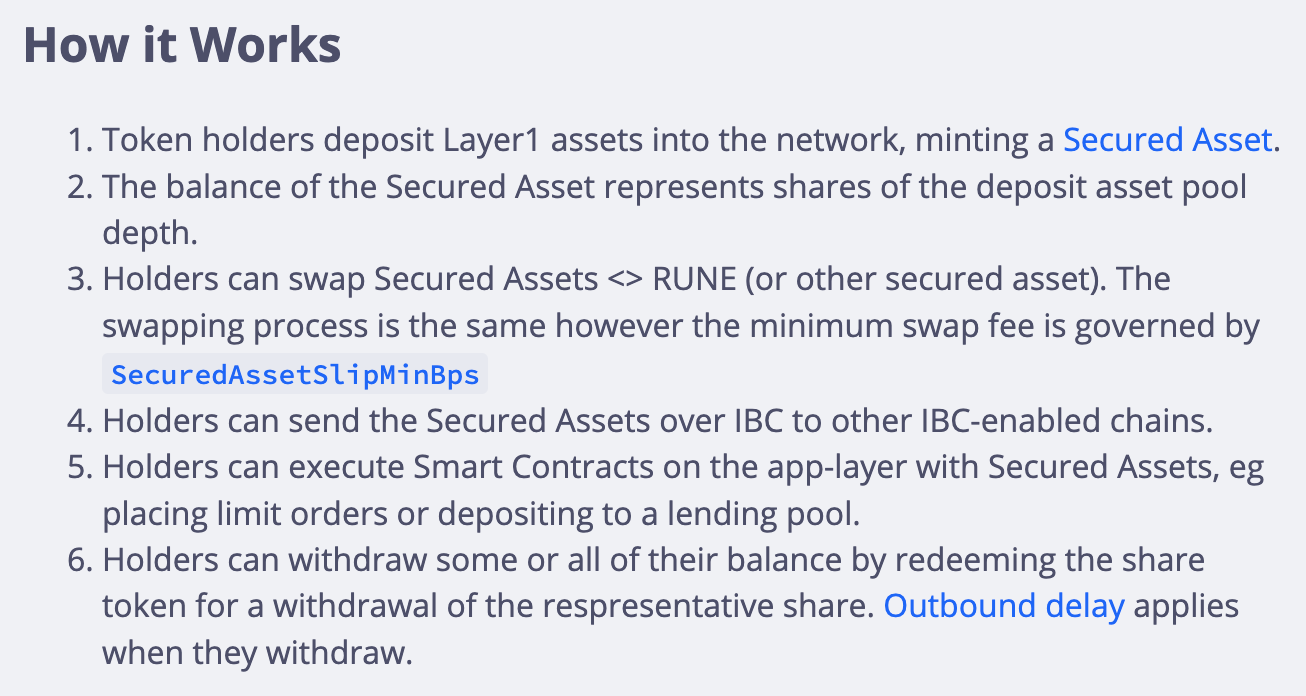

When a user deposits a native asset like BTC into a credit account, that asset is secured directly within THORChain’s decentralised vaults. These vaults are collectively controlled by a rotating set of node operators using threshold cryptography. No single party can move funds, and keys are regularly rotated to reduce long-term attack risk.

To represent deposited assets within the application layer, THORChain uses Secured Assets. These are protocol-native representations backed one-to-one by assets held in THORChain vaults. They are not traditional wrapped tokens bridged to another chain, as they live within THORChain and Rujira themselves.

👉 In simple terms, Secured Assets act as verifiable receipts for native assets secured by the network, without adding an extra layer of trust or risk.

2️⃣ What Credit Accounts Enable

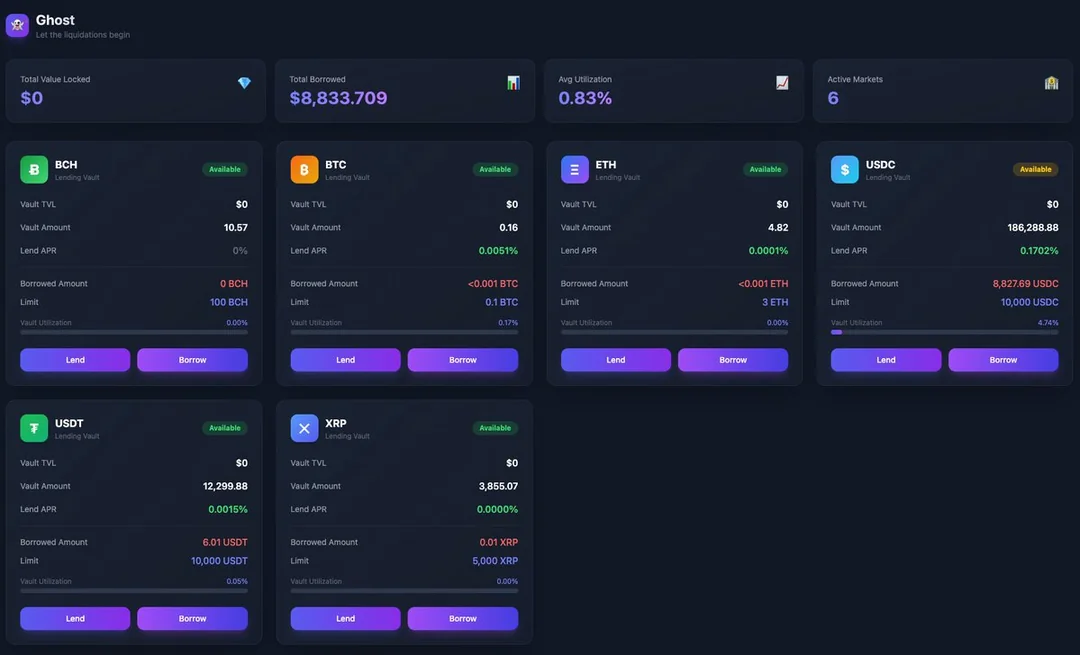

Credit accounts unlock a broad set of capabilities across the THORChain ecosystem.

For users, they improve capital efficiency without giving up custody. For builders, they introduce a native credit primitive that enables more advanced onchain financial products. All while relying on protocol-enforced risk management and base-layer security.

Core User Capabilities

🔹 Borrow Without Selling

Users can borrow stablecoins against assets like BTC or ETH without selling their long-term holdings. This allows miners, traders, and long-term holders to access liquidity while maintaining market exposure.

Instead of exiting positions or bridging assets elsewhere, users remain fully within THORChain’s security model.

🔹 No Wrapping or Centralised Risk

Collateral remains native, secured directly by the protocol’s vaults and represented internally without ever leaving the THORChain environment. There are no synthetic representations issued on another chain and no dependency on external bridge contracts.

Potential Product Directions for RUJIRA

As credit account matures, they enable a new generation of products that rely on native collateral, onchain risk management, and protocol-enforced guarantees. Some of the most promising directions include:

🔹BTC-Backed Stablecoins

As credit accounts scale, they can support overcollateralised stablecoin issuance backed by native BTC.

The infrastructure already allows users to deposit BTC as collateral and borrow stablecoins against it, for example depositing $150 worth of BTC to borrow $100 in stablecoins. Collateral ratios are enforced by the protocol, and positions are automatically liquidated if safety thresholds are breached.

Unlike centralised stablecoins that rely on custodians and opaque reserves, this model maintains its peg through transparent, onchain mechanisms and economic incentives, with all collateral verifiable at the base layer.

🔹Spot Margin Trading

Credit accounts can enable native spot margin trading on Rujira.

Users can deposit collateral, borrow additional funds, and swap into another asset within a single atomic flow. The position can later be closed by reversing the trade, repaying the borrowed amount, and retaining any remaining profit.

This replicates the core functionality of centralised exchanges while preserving self-custody and avoiding trusted intermediaries.

🔹Perpetual Futures v2

Looking further ahead, credit accounts provide the foundation for a new generation of perpetual futures on Rujira.

Perpetual contracts can draw margin directly from a user’s credit account, manage leverage through collateral ratios, and enforce liquidations automatically when risk limits are breached. Settlement and risk management remain fully onchain, without relying on opaque funding mechanisms or discretionary intervention.

Because collateral and debt remain native, perpetual exposure can be offered across any asset pair supported by THORChain.

Risk, Collateral, and Security Model

🔹 Multi-Collateral by Design

Unlike many lending systems that require separate positions for each asset, credit accounts support multiple collateral types within a single account.

A user can deposit BTC, ETH, and BCH together, borrow against their combined value, and manage everything from one position. Collateral is valued using THORChain’s built-in pricing mechanisms, and borrowing capacity adjusts dynamically.

This flexibility makes credit accounts suitable for more advanced strategies without increasing operational complexity for users.

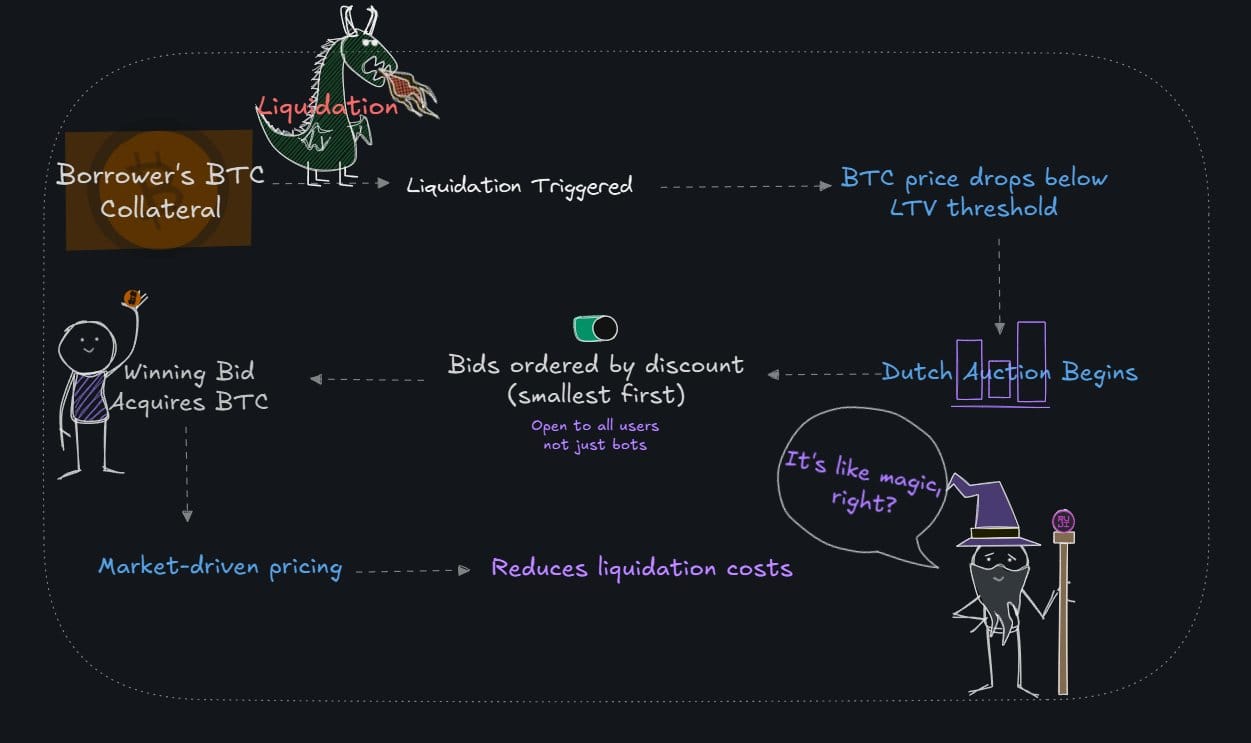

🔹Liquidations and Risk Enforcement

Credit accounts use familiar, transparent risk controls:

- Loan-to-value ratios define borrowing limits.

- Liquidation thresholds protect lenders when collateral values fall.

- Interest rates adjust dynamically based on utilisation, balancing supply and demand without manual intervention.

When a position becomes undercollateralised, liquidations are triggered automatically. Collateral is sold through onchain markets to repay outstanding debt, and any remaining value is returned to the user.

🔹Base-Layer Security Guarantees

Credit accounts inherit THORChain’s security model. Native assets are secured by decentralised vaults controlled through threshold signatures and rotating node sets. At the application layer, where Secured Assets are managed, contracts are audited, permissioned, and subject to governance oversight.

If an issue is detected, the network can pause specific contracts or the broader application layer, while native assets remain secured at the base layer.

4️⃣ What Credit Accounts Unlock For THORChain

Until now, THORChain has been primarily associated with trustless, cross-chain swaps. With credit accounts, and through Rujira, the protocol expands into lending, leverage, and more advanced DeFi activity, all while keeping assets native and trust assumptions minimal. This matters for a few simple reasons:

- First, capital becomes stickier. Users no longer need to bridge assets elsewhere to borrow or deploy leverage.

- Second, usage deepens. Lending and credit are foundational components of any financial system.

- Finally, credit-driven activity generates new fee flows that circulate back to the network and its stakeholders, reinforcing long-term sustainability.

Credit accounts are live since the end of 2025, with CDP loans already operational, but they are best understood as infrastructure rather than a finished product. As the system matures, they open the door to a fuller suite of DeFi primitives built on native assets and enforced by protocol rules.

DeFi on THORChain is no longer just about swaps. It is beginning to take shape as a more complete financial system.

For ecosystem news and protocol updates, follow @THORChain and @RujiraNetwork on X.