Enshrined Oracles: Giving THORChain Eyes on the Market

There’s a big change coming to THORChain that you might have already heard about: ENSHRINED ORACLES 🧿

But what exactly are they, how do they differ from traditional oracles, and why does this upgrade matter for the future of the network?

Let’s dive in. ⤵️

❓Why Oracles Matter in the First Place

Imagine running an auction without knowing the true market price of what you’re selling. You could let something go far too cheaply, or buyers might end up overpaying, while arbitrageurs quickly exploit the gap.

This is exactly the challenge blockchains face without oracles: they have perfect knowledge of their own ledger, but no visibility into the outside world, such as the price of an asset on a centralised exchange or other markets.

THORChain solved this by using pool ratios.

👉When someone swapped assets, the pool balances shifted so that prices automatically adjusted to supply and demand.

How? Thanks to arbitrage traders who would step in whenever THORChain’s pool prices drifted away from centralised exchanges or other pools, keeping the system roughly in line with reality. ⚖️

⚙️How a Usual Oracle Works ?

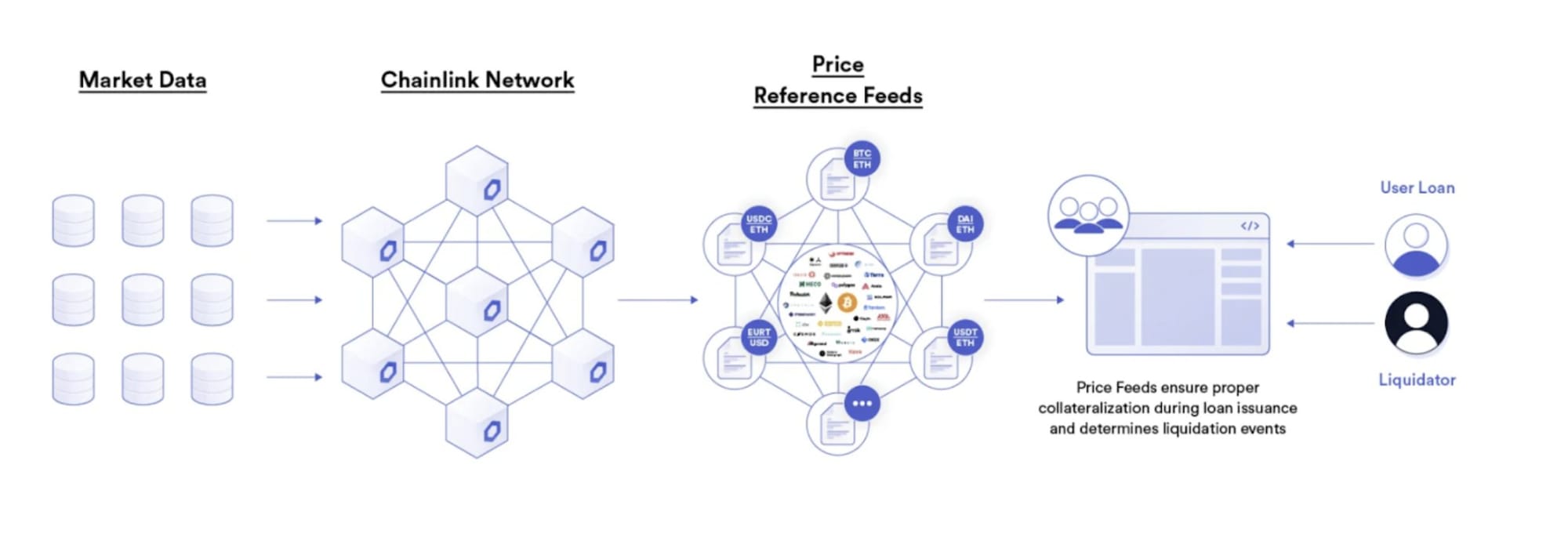

In most of DeFi, oracles function as external services that deliver data into the blockchain. They query multiple exchanges or price feeds, combine those results into a reference value, and then publish that value onchain at regular intervals.

👉This effectively creates a bridge between the blockchain and the outside world.

Since blockchains cannot directly observe external markets, they rely on oracles and their networks of data providers to supply accurate information. These updates are what keep applications running: lending protocols need prices to manage collateral, DEXs use them for swaps, and derivatives depend on them for settlement.

Pros and cons

➕ This model has clear strengths. It gives blockchains access to knowledge they otherwise could never reach, and by sourcing from multiple markets it reduces the risk of one bad feed distorting results.

➖ At the same time, the approach is inherently external. The oracle operates outside the chain’s consensus, maintained by its own participants and subject to its own trust assumptions.

🧿Enshrined Oracles in THORChain

THORChain’s upcoming upgrade takes a very different approach.

👉Instead of depending on an external oracle network, the oracle is now built directly into the protocol itself. In other words, pricing becomes part of consensus, not something imported from outside.

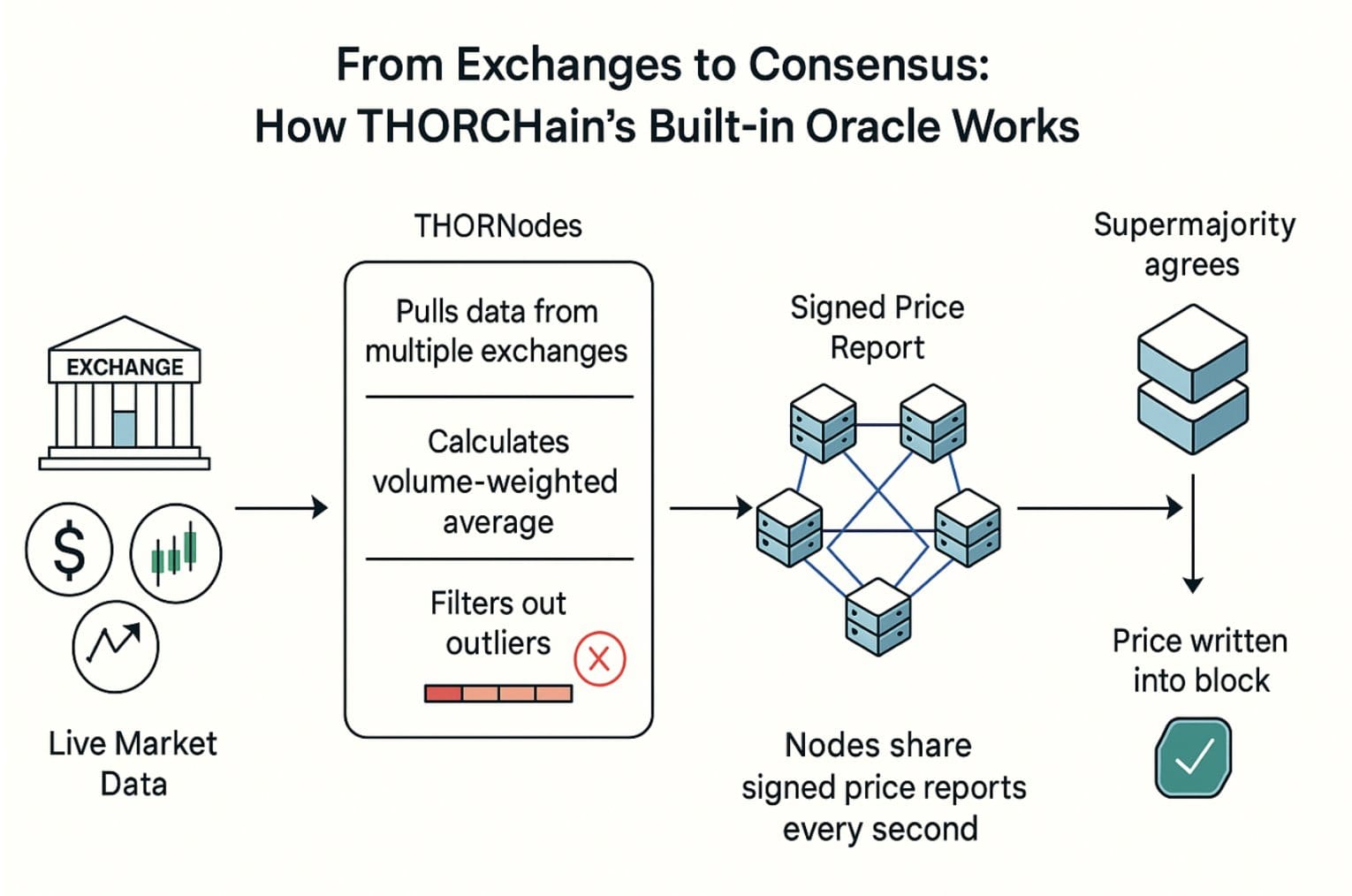

🔽 Here’s how it works in practice 🔽

Each THORNode connects directly to several major exchanges and pulls live price data for supported assets.

By checking multiple venues at once, no single exchange can dominate or distort the result. The node then calculates a volume-weighted average price, giving more influence to exchanges with deeper trading activity.

Note : Outlier quotes, values that sit far away from the rest, are ignored to prevent errors from slipping in.

Once a node has its final value, it signs it and gossips (share internally) it to the rest of the network.

👉This happens every second, so fresh prices are constantly moving through the system.

When a block is proposed, the proposer already has these reports in hand. If a supermajority of nodes agree, the price is accepted and written into the chain as part of the block. Importantly, that price is valid only for the block in which it appears, forcing the system to refresh continuously.

What about trust?

The incentives are aligned at the validator level. Nodes that fail to report, or submit clearly wrong values, can be penalised or slashed. Since validators have significant capital bonded to their role, they are economically motivated to remain honest.

What about the operational cost ?

Fetching data from multiple exchanges and gossiping every second adds around 12GB of traffic per node per day. But the trade-off is a network that no longer relies on third-party oracles.

👉THORChain becomes its own price source: fast, native, and trustless.

🤔Why This Matters for Users ?

For the ordinary user, these mechanics are invisible, but their impact is substantial.

👉With enshrined oracles, swaps executed through THORChain reflect real, aggregated market conditions rather than delayed or potentially corrupted feeds.

Liquidity providers , swappers and traders can trust that pool valuations are correct and resistant to manipulation. The protocol becomes harder to attack, since an adversary would need to manipulate several high-volume markets simultaneously and compromise a majority of validators, a task orders of magnitude more difficult than tricking a single oracle provider.

👉More importantly, enshrined oracles unlock entirely new categories of products.

Until now, THORChain has been constrained in what it can support because reliable base-layer pricing did not exist. With the oracle function enshrined in consensus, lending, structured products, and derivatives can be built directly on top of the protocol with confidence.

📈Rujira and the Next Frontier

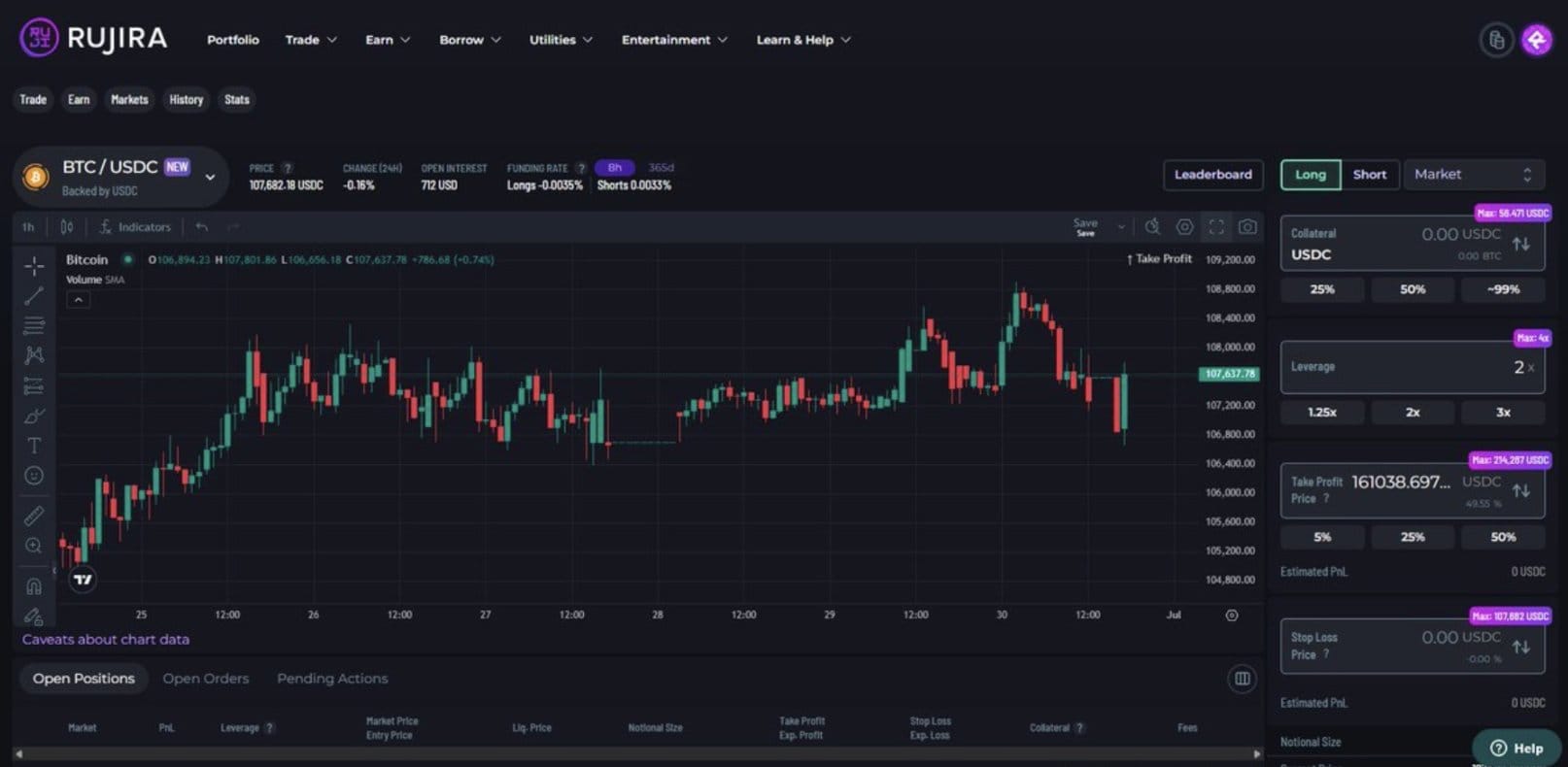

This is where @RujiraNetwork comes in. Rujira is the application layer that extends THORChain into advanced financial services such as orderbooks, perpetual futures, lending markets, and strategy engines.

👉All of these rely on accurate, tamper-resistant pricing.

Perpetuals are the clearest example. They cannot run without a trusted mark price. Rujira Perps will use THORChain’s enshrined oracle to calculate profit and loss, set funding rates, and trigger liquidations. With prices updated every block from multiple venues, perps become safer: liquidations are fair, PnL reflects consensus reality, and even long-tail assets can be supported without bringing in new external oracles.

Lending is no less dependent. Reliable valuations keep loans properly collateralised, ensure health factors are accurate, and trigger liquidations before bad debt builds up. By anchoring to base-layer oracles, Rujira Lending reduces risks that would exist if it relied on outside feeds.

Even Rujira’s strategy layer, which arbitrages between the THORChain AMM and Rujira’s orderbook, needs precise, block-level prices. Rebalancing, hedging, and liquidity strategies only work if they are guided by real-time, consensus-driven data.

👉In short, enshrined oracles are key for Rujira’s growth.

Without them, perps, lending, and strategy engines would carry unacceptable oracle risk. With them, these products can offer innovative features and scale confidently, protected by the same consensus that secures THORChain itself.

💭Closing

Enshrined oracles bring price discovery into the heart of THORChain. Instead of depending on external feeds, every node now helps secure accurate, up-to-date market data as part of consensus.

This upgrade makes the network more reliable, more resistant to manipulation, and better equipped to deliver fair outcomes for both traders and liquidity providers. ⚡️

The change will go live shortly after v3.10 is released. From that point onward, every swap and every pool valuation will be backed by a system that is as secure as the protocol itself.

This is a step that strengthens THORChain at its foundation and prepares it for the next wave of innovation across the network.