From v3.4 to v3.14: How THORChain Changed in 2025

Between March and December 2025, THORChain entered a period of accelerated development. This translated into more than 220 merge requests delivered across 11 major protocol upgrades.

As the year draws to a close, this is a good moment to step back and assess how THORChain has evolved from a robust cross-chain DEX into a broader DeFi infrastructure layer.

Buckle up. ⤵️

0️⃣ TLDR

From V3.4.0 to V3.14.0, here's what THORChain accomplished:

✅ Integrated 2 major chains (TRON, XRP) with Solana, Noble USDC, and Zcash code complete and ready to go.

✅ Launched the App Layer with Rujira (Trade, Perps...).

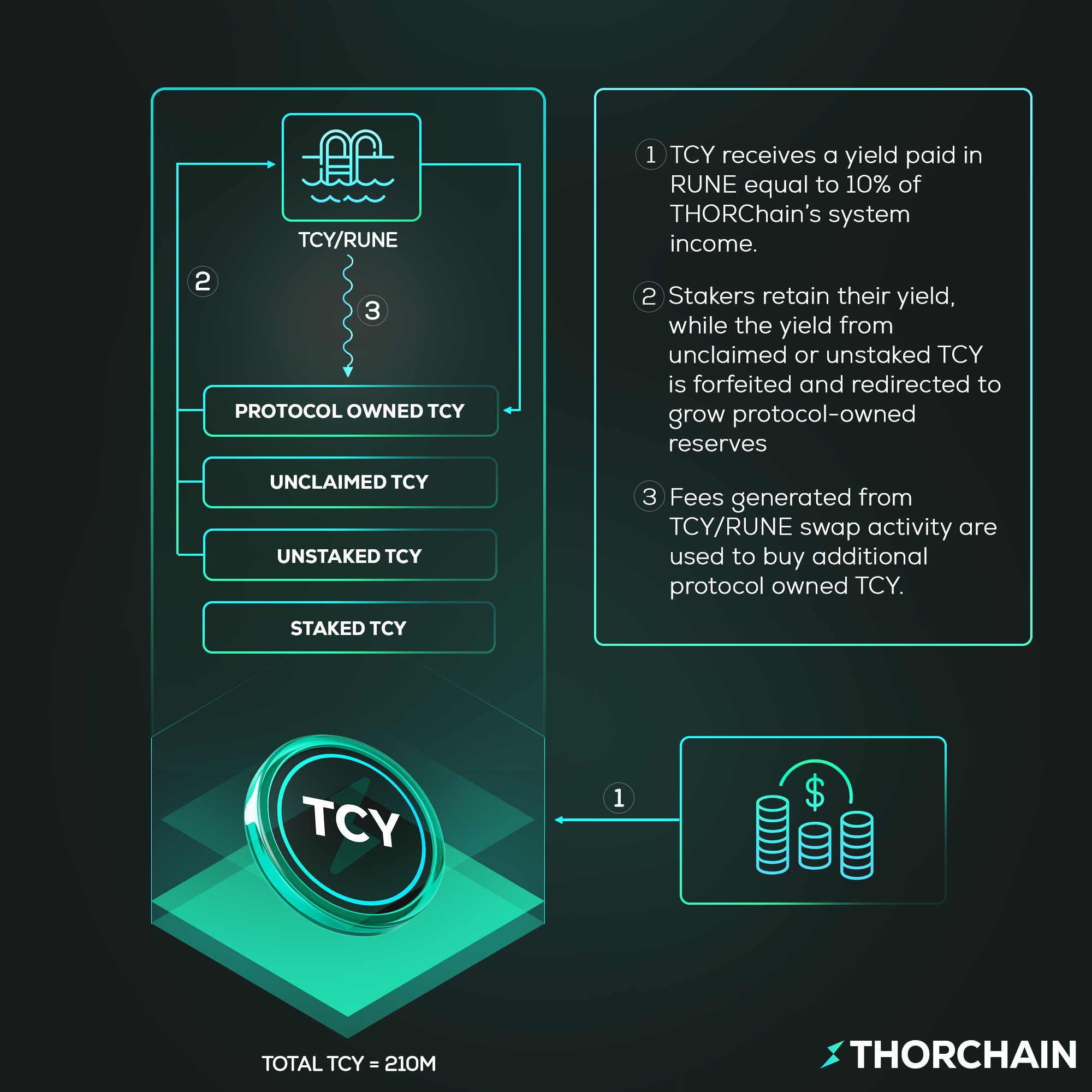

✅ Launched TCY, directing 10% of protocol fees to stakers after THORFi sunset.

✅ Shipped limit orders, rapid swaps, streaming swaps that rival CEX features.

✅ Eliminated memos for a smoothest UX in cross chain DeFi.

✅ Launched the marketing fund using 5% of the protocol revenue.

✅ Introduced enshrined oracles removing external dependencies.

✅ Hardened security with intelligent recovery, granular halts, critical bug fixes.

✅ Improved node operations with scheduled migrations, maintenance mode, faster recovery.

✅ Built comprehensive testing and dev tooling for faster iteration

1️⃣ NEW CHAINS JOINING THE PARTY

🔹XRP (V3.4)

XRP is one of the most traded assets in crypto, but completely isolated from DeFi. No native cross chain swaps, no decentralized access, just centralised exchanges with all their friction.

THORChain fixed that on March 27, 2025 with V3.4.0. XRP integration went live, connecting over $100 billion in XRP liquidity to the rest of crypto. No bridges. No wrapped tokens. Native $XRP swapping across every chain THORChain supports.

The entire ecosystem gained XRP support simultaneously through SwapKit: Trust Wallet, THORSwap, Vultisig, LeoDex, THORWallet, Edge Wallet, all at once.

🔹 TRON (V3.7 → V3.10)

Remember when we were all waiting for TRON?

The groundwork started way back in V3.7 (June 17, 2025) and V3.8 (July 16, 2025), but V3.10 (August 28, 2025) is when it actually happened. TRON.USDT got whitelisted, and suddenly THORChain was connected to one of the biggest stablecoin networks in crypto.

We're talking billions in daily volume and millions of users who can now swap natively without touching a single bridge. Freedom!

🔹SOL - Almost There (V3.8 → V3.12)

What about Solana integration? This has been the one everyone's been watching.

It started with EDDSA architecture landing in V3.8 (July 16, 2025), which also opened the door for TON and ADA down the road. Getting Solana working took months of serious development work. Custom built scanners, native SOL deposits, vault operations, the whole nine yards. Integrating natively Solana is a complex task!

V3.12 (November 4, 2025) is when the code came together. Final fixes included vault accounting corrections, outbound correlation security patches, database error prevention, and simulation stability improvements.

👉 The good news? Solana is code complete. All the heavy lifting is done.

The current status? Final testing phase. A new dedicated "chainnet" team is now handling the final testing and validation before mainnet launch. We're talking about integrating one of the fastest and largest ecosystems in crypto, so taking the time to get it right matters. 👌

Once testing clears and node operators are ready, Solana goes live.

🔹Noble USDC - Key For Native DeFi On Rujira (V3.9)

Here's something that flew under the radar for a lot of people: Noble blockchain integration work started in V3.9 (July 31, 2025).

Noble is the only Circle authorised USDC issuer on Cosmos. The integration brings real, actual, fiat backed USDC into THORChain without any synthetic nonsense or bridge risk.

👉 Current Status: Noble integration is complete on the code side but not yet live on mainnet. This one will come after Solana.

Once it goes live, this unlocks massive composability across the Cosmos ecosystem, supporting the App Layer products such as like lending, payments, cross chain DeFi services, you name it.

👉 Noble USDC + THORChain = secure stablecoin infrastructure for the entire multi chain economy. Worth the wait.

🔹ZEC - Prep Work (V3.13)

V3.13 (November 20, 2025) laid all the groundwork for Zcash. Asset definitions, fee parameters, block timing, validation rules, the whole package got added to THORChain's common package (Big shoutout to Maya Protocol whose initial work on their chain made this work seamless for THORChain).

Current status? Zcash transparent addresses are code complete and in the testing phase, similar to Solana. The new chainnet team is handling final validation before mainnet deployment.

2️⃣ SWAPS GOT A MASSIVE UPGRADE

🔸Limit Swaps (V3.10 → V3.11)

Limit Swaps are exactly what they sound like. You set a target price and your swap waits in the queue until pool conditions are favorable. No more instant fails if the price isn't right. It's like having an order book, except you're still trading against liquidity pools, not matching with other traders.

Time to Live (TTL) automatically closes limit swaps after 3 days and returns your funds. Keeps the system clean, prevents swaps from sitting in limbo forever.

🔸Rapid Swaps (V3.10 → V3.11)

Rapid Swaps process multiple rounds of swaps (adjustable via Mimir) per block instead of just one at a time. Throughput goes way up, execution time goes way down.

🔸Streaming Limit Swaps (V3.10)

Got a huge order you want to execute? Streaming Limit Swaps slice it into timed sub limit swaps, giving you partial fills over time at or better than your target price.

Think of it like DCA, but automated and price aware. Less slippage on big trades, better execution quality. 👌

-

As with any major innovation, systems can break, behave unexpectedly, or require further tuning. As a result, despite being introduced in v3.10 and v3.11, the new swap logic underwent multiple rounds of refinement across subsequent releases.

V3.11 (September 18, 2025) brought better rapid swap logic, improved limit swap detection, fixed scoring so nobody could game the system, patched division by zero bugs (those are always fun), and added comprehensive telemetry for monitoring.

V3.12 (November 4, 2025) made rapid swap iterations smarter, improved how the queue discovers limits, ensured swap scoring is based on actual L1 pools, added streaming swap safety checks, and dropped full documentation for developers.

V3.13 (November 20, 2025) gave us a dedicated limit order quote API endpoint. TTL handling, max streaming quantities, OpenAPI docs for integrators, the works.

V3.14 (December 5, 2025) fixed a nasty bug where trade and secured assets were getting 13 minute delays (nobody enjoyed that), and corrected quote API time estimates for rapid swaps based on actual per block limits.

💭 What This All Means?

THORChain is approaching CEX-level trading functionality, offering lower slippage, faster execution, and improved price and time controls. All of this operates trustlessly on-chain, without intermediaries and without custodial risk. ⚡

3️⃣ MEMOLESS TRANSACTIONS (V3.12)

Let's be real. Memos were a headache when using THORChain.

Until V3.12 (November 4, 2025), every single inbound transaction needed a memo to tell THORChain what to do. Swap? Memo. Add liquidity? Memo. Basically anything needed a Memo.

Miss the memo or mess it up? Your funds get stuck. Cue the panic, the Discord messages, the manual recovery process. Not fun for anyone.

V3.12 changed everything with a reference system that lets users send funds without a memo and attach the correct intent afterwards via API.

What This Unlocks

- CEX style deposits (send now, specify action later)

- Bulk deposits without memo management headaches

- Way easier integrations for DEXs and wallets

- Dramatically fewer user errors and stuck funds

- Opens the door to intents (coming in 2026)

👉 Most importantly, no wallet connection is required. Scan a QR code, send funds, and THORChain handles the rest. 🧠

4️⃣ RUJIRA APP LAYER

The App Layer lets developers build DeFi apps directly on THORChain, secured by the same validator set and economic model.

Everything started with V3.4.0 (March 27, 2025) bringing the App Layer Token Factory, the infrastructure piece that would enable protocols to mint their own tokens on THORChain. This was the foundation that made everything else possible.

V3.5.0 (May 1, 2025) was supposed to be the big Rujira launch. The TGE was planned, the community was ready, but then an LP deposit accounting bug showed up during final testing on devnet. @codehans1 pushed fixes and Rujira finally went live with V3.6.0. 🙌

Since its introduction, the App Layer has seen a steady expansion of features and permissions.

v3.7 (June 17, 2025) approved the NAMI Index, formally recognised Levana Perps, and enabled smart contracts to deploy other contracts without permission checks. This last change was a major step forward for composability.

v3.8 (July 16, 2025) authorised DAO DAO and AutoRujira. It also introduced a new mechanism for secured assets, allowing them to be deposited into liquidity pools via burning and withdrawn through minting. This laid the groundwork for tokenised LP positions.

v3.9 (July 31, 2025) fixed the RUJI Merge contract, allowing users to finally claim their tokens, and added permissions for yRUNE and yTCY, enabling the launch of the NAMI Index.

The same release replaced the slow, manual approval process with a trusted deployer list. Vetted developers can now deploy directly, significantly accelerating iteration without increasing protocol risk.

v3.12 (November 4, 2025) expanded deployment permissions to DAO DAO, Fuzion, Calc, and Liquidy, and whitelisted AUTO and LQDY for liquidity pools. It also introduced a 3-of-4 multisig for contract management.

In parallel, the addition of repository CODEOWNERS allows App Layer teams to approve their own code changes, further improving development velocity. Finally, the authz module enables scoped delegated authorisation, supporting more advanced automation workflows.

💭 What It Means ?

Before v3, extending THORChain often meant modifying the base layer. This increased protocol risk, slowed iteration, and limited experimentation. The THORFi era.

👉 The introduction of the App Layer fundamentally changed this model. Applications can now be built as smart contracts on top of THORChain, accessing native cross-chain liquidity without adding protocol-level risk.

As a result, Rujira is evolving into a full DeFi ecosystem built natively on THORChain. Perpetuals, yield indices, lending protocols, DAOs, and automated strategies operate directly on the network, without external dependencies or added trust assumptions.

This is what native DeFi looks like. 🧠

5️⃣ TCY Token Launch (V3.5)

V3.5.0 (May 1, 2025) introduced TCY, a protocol native yield token designed to realign incentives after the THORFi shutdown.

👉 TCY officially launched on May 5, 2025, providing users with a new way to earn passive income, with 10% of protocol fees distributed in RUNE.

6️⃣ PROTOCOL INFRASTRUCTURE UPGRADES

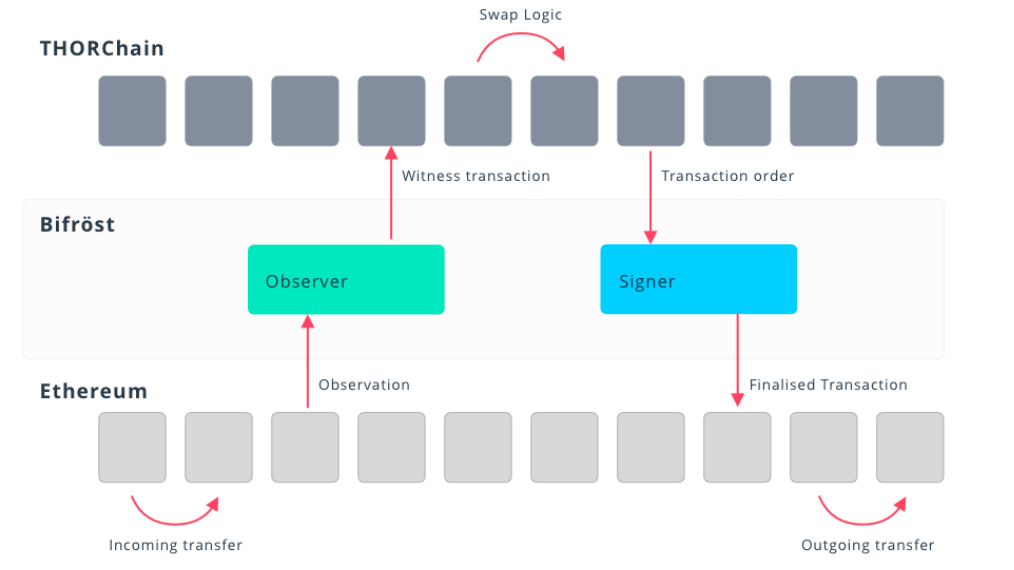

🔸 Bifrost Refactor (V3.5)

V3.5.0 (May 1, 2025) wasn't a feature release. This was an engine rebuild.

Bifrost is THORChain's connection to the outside world. Every $BTC deposit, every $ETH swap, every chain it watches, it all flows through Bifrost. V3.5.0 completely refactored how Bifrost processes observations.

Before: Every validator spammed the chain with duplicate observation messages. Slow, messy, congested.

After: Validators reach consensus through a gossip network first, then submit a single confirmed message. Cleaner, faster, scalable.

The goal: greater network efficiency as Rujira scales.

🔸Enshrined Oracles (V3.10)

V3.10 (August 28, 2025) introduced protocol native oracles. Here's how it works:

THORNodes connect to major exchanges, pull live price data for supported assets, calculate volume weighted average prices, and reach consensus on final values.

👉This replaces reliance on external oracle networks or THORChain's own pools. More accurate, more reliable, and way more resilient.

Enshrined Oracles are particularly important for Rujira where Perps and other sensitive trading apps need precise price feeds without manipulation and downtime.

🔸Distinct Security Mandated Outbound Delays (V3.5)

V3.5.0 fixed a timing issue in how THORChain schedules outbound transactions. Normally, large transfers need to wait a set delay for security reasons. But if a smaller, fast transfer was bundled with a large one, the system could mistakenly send both at the same time, risking early execution.

This update ensures each outbound waits the correct amount of time, even when multiple outbounds are triggered by the same transaction. It tracks the maximum delay required and applies it properly.

Beyond fixing the bug, this also lays groundwork for customisable outbound delays in the future based on blockchain, trade size, or even trader loyalty.

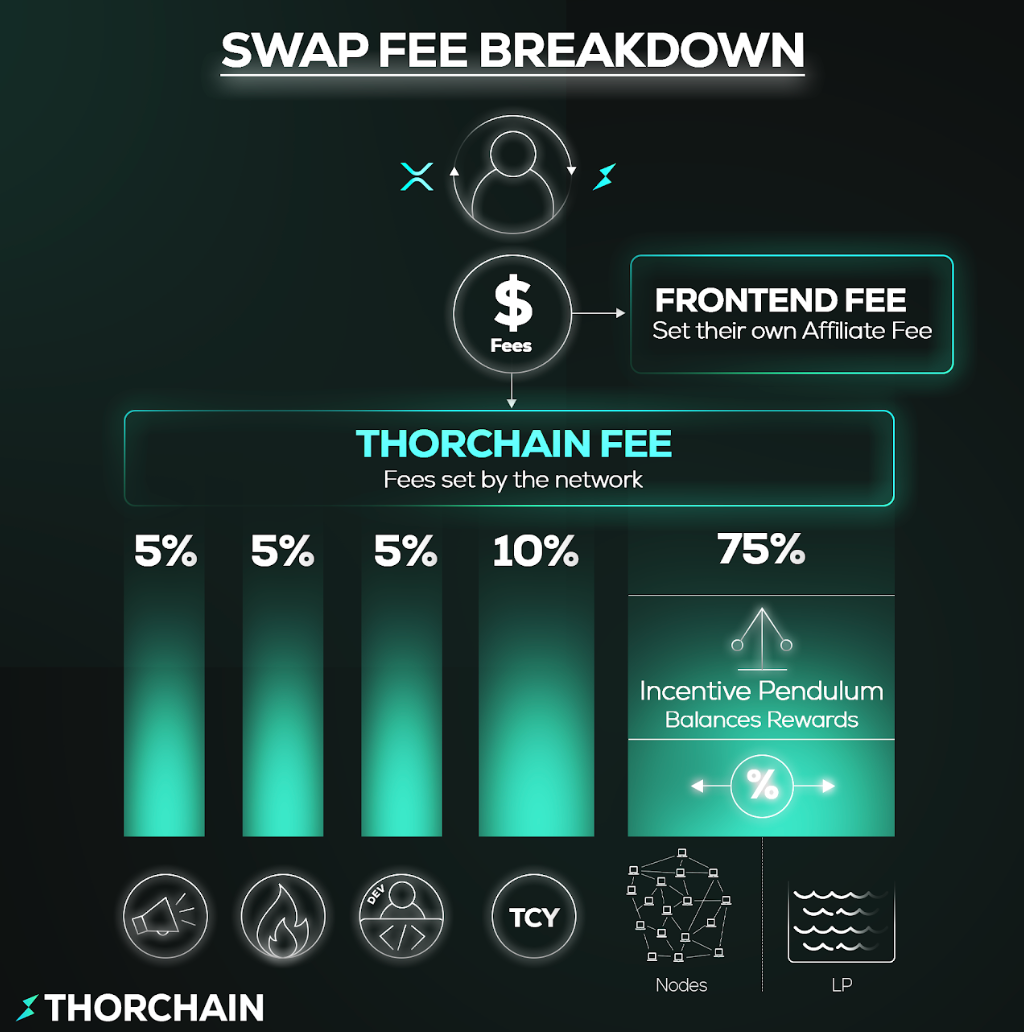

7️⃣ MARKETING FUND - ADR021 (V3.11)

Remember the marketing fund proposal? v3.11 (September 18, 2025) put it into effect.

👉 5% of protocol revenue now flows into a dedicated marketing budget, funding ecosystem growth, content, partnerships, and awareness without external capital or dilution.

v3.11 also introduced reserve cap optimisation. Idle fees held in the Reserve are now capped, with excess RUNE emitted back into circulation. This decision offset the marketing fund’s impact on yields for TCY holders and Node Operators.

With ADR021, THORChain gains a sustainable, protocol-native funding mechanism for growth, creating a flywheel where higher revenue supports greater marketing capacity.

8️⃣ MINOR OPERATIONAL REFINEMENTS

Not every protocol upgrade is headline-grabbing. Many changes address edge cases, operational friction, or long-standing inefficiencies. Taken in isolation, these improvements may appear minor. Stacked over time, however, they materially strengthen THORChain’s reliability, security, and developer experience.

🔸Security, Scalibility and Stability

- Base chain token support (v3.4)

Prepared THORChain for deeper integration with the Base ecosystem, expanding cross-chain surface area. - Expanded DEX aggregator and router support (v3.5–v3.10)

Broader token coverage and improved routing logic across aggregators like SwapKit reduce integration friction. - Asset whitelist expansions (v3.8–v3.10)

Added support for multiple wrapped assets (cbADA, cbDOGE, cbLTC, cbXRP), keeping integrations current and flexible. - Advanced swap queue terminology update (v3.6)

Formalised “Advanced Swap Queues” terminology, reflecting architectural maturity and clarifying documentation. - Whitelisted contract endpoint (v3.6)

Added an endpoint for querying all whitelisted contracts, simplifying App Layer integrations and developer tooling. - Improved BSC block timing (v3.6)

Block timing logic aligned more closely with BSC, improving cross-chain consistency and outbound reliability. - Support for newer Ethereum features (EIP-7702, v3.7)

Ensures continued compatibility with Ethereum’s evolving execution environment. - Stale trading detection and frontend signals (v3.7)

New API fields signal halted pools or stale price data, allowing frontends to warn users and prevent unsafe trades. - Bitcoin reliability improvements (v3.7–v3.13)

Longer memos supported, UTXO ancestor limits enforced, and outbound reliability improved across BTC-like chains. - Improved gas and fee accuracy (v3.8–v3.12)

Rebalanced fee multipliers, adjusted BTC dust thresholds, reduced fee noise, and fixed affiliate fee ordering. - IBC direct deposits (v3.7–v3.8)

Single-step deposits via IBC, reducing friction, gas costs, and complexity. - Bond wallet migration (v3.8)

Bond providers can migrate wallets without interrupting bond continuity. - Environment consistency (v3.12)

Block times aligned across mocknet, stagenet, and mainnet, reducing race conditions. - WASM, oracle, and monitoring upgrades (v3.8–v3.13)

Improved telemetry, safer oracle handling, pinned WASM code on migration, scoped authz for automation, and better quote handling for apps. - Smarter slashing logic (v3.13)

Cancel transactions no longer trigger false slashes or network-wide halts. Slashing is now granular, chain-specific, and safer. A double gas deduction bug was also fixed. - Scheduled migration manager (v3.13)

Migrations now execute independently of upgrade blocks via Mimir-defined heights, dramatically reducing risk during upgrades. - Division-by-zero safeguards (v3.13)

Guard checks added across consensus-critical paths (outbounds, loans, emissions, fees), eliminating multiple halt and miscalculation risks. - Deterministic outbound recovery (v3.13)

Failed outbounds now follow automatic, deterministic recovery paths. Swaps reverse back to users when possible, otherwise funds route to treasury. No funds remain stuck. - Dust-aware minimums and affiliate fee accuracy (v3.13)

Minimum swap amounts now correctly account for dust thresholds and affiliate fees, preventing swaps from failing despite being “above minimum.” - Outbound checkpointing (v3.14)

All outbounds are checkpointed when built, even on signer failure. Prevents silent failures and untracked transactions. - Retired vault handling (v3.14)

Refunds from inactive vaults now auto-retry until successful. Legacy dust is cleaned up, reducing operational risk and manual intervention. - Deterministic quotes (v3.14)

Removed randomness in fee and legacy loan logic. Identical inputs now always produce identical quotes, improving reliability for contracts and integrators.

Result:

Each release tightens resilience, reduces edge-case risk, and hardens THORChain against rare failure modes. This is mature protocol development.

🔸Node Operators

- Improved node rotation (v3.4)

Enhanced rotation mechanics improve flexibility and operational safety for node operators. - Maintenance mode (v3.7)

Nodes can enter standby without churn or slashing, enabling safe, planned maintenance. - Smarter churn mechanics (v3.12–v3.13)

Faster rejoin times, clearer churn alerts, and improved offender selection based on missed signatures.

Result:

Node operations are safer, smoother, and far more predictable. Migrations are controlled, monitoring is richer, and edge cases are handled gracefully

🔸Testing & Developer Experience

- Expanded regression testing (v3.8)

Full coverage for limit swaps and advanced swap queue logic. - Advanced performance testing (v3.13)

Benchmarks, profiling, flamegraphs, parallel tests, and targeted test execution added. - MacOS support (v3.12)

Mocknet and simulations now run cleanly on Mac, improving contributor accessibility. - Clearer documentation (v3.10–v3.13)

Detailed docs for advanced swap queues and upgrade configuration reduce rollout friction.

Result:

Better tools, clearer docs, and stronger test coverage accelerate development while improving code quality.

9️⃣ FINAL THOUGHTS

In just a few months, THORChain delivered a step change in capability. The protocol is integrating more chains, becoming more efficient, and hardening its resilience with each release. Progress is continuous, iterative, and visible. ⚡

On top of this foundation, native DeFi is now operating without bridges, wrapping, or custodial risk. Applications can access cross-chain liquidity directly, secured by bonded validators and aligned economic incentives. Just as importantly, this system is sustainably funded through real protocol revenue rather than inflation and incentives, a rarity in DeFi. 💰

With further integrations on the horizon and a rapidly expanding application layer, 2026 is shaping up to be a defining year for native, cross-chain DeFi.

THORChain is not theorising the future. It is shipping it.

For detailed technical information on any specific upgrade, check the official THORChain dev docs. For protocol updates and ecosystem news, follow @THORChain on X.

The journey continues ⚡️