Rapid Swaps: Leveling Up Swap Efficiency on THORChain

Rapid Swaps: Leveling Up Swap Efficiency on THORChain Rapid Swaps and Limit Swaps are two core innovations coming to THORChain in the next few weeks.

Combined with a series of smaller updates, they mark the beginning of a new era of trading, one where THORChain starts to resemble an “orderbook,” while still keeping its own unique design. ⚡️

Each deserves its own deep dive, so today we’ll start with Rapid Swaps.

❓What Problem Do Rapid Swaps Solve?

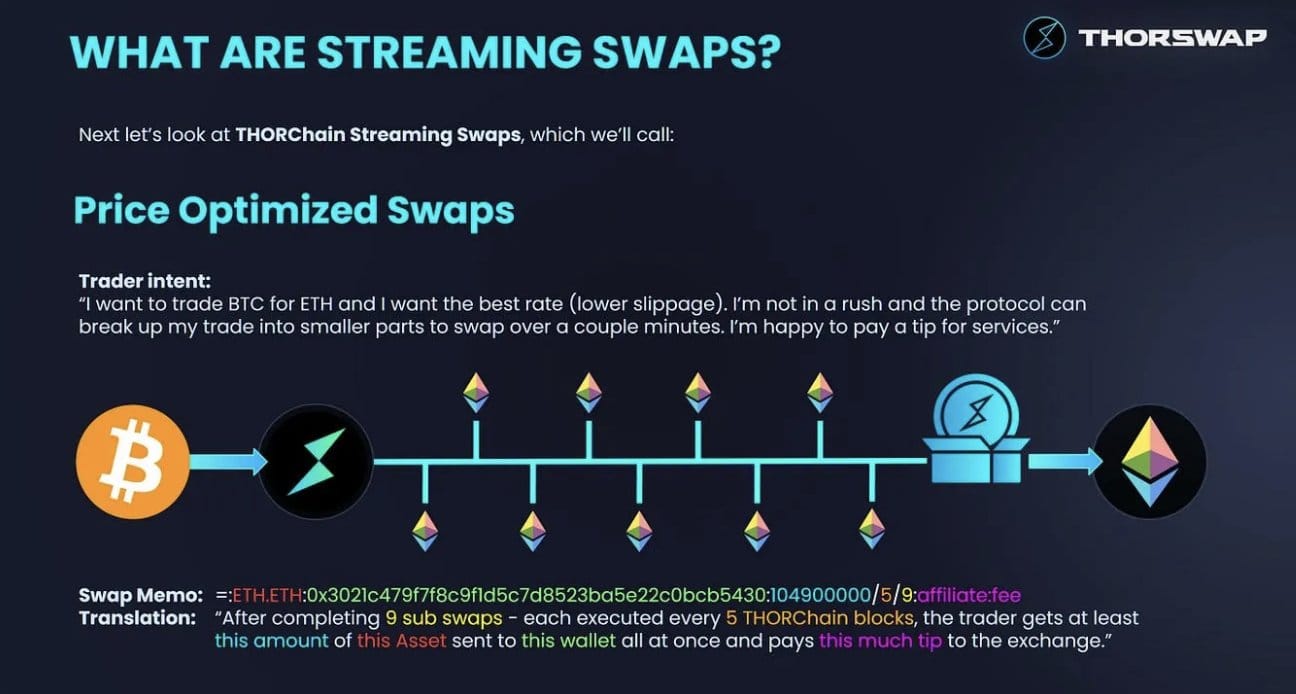

👉 THORChain has historically processed large trades using a mechanism called Streaming Swaps.

When a user swaps a large amount of one token for another, THORChain doesn’t execute the entire trade in a single transaction. Instead, it splits the swap into smaller chunks spread across several blocks. This reduces slippage and provides much better execution for large trades.

👉However, this system has one major downside: it introduces latency.

If the pool price moves outside the acceptable range during execution, the Streaming Swap may be delayed or fail to execute entirely, resulting in a refund even when a counterparty is available to trade instantly at the desired price.

👉And this is exactly where Rapid Swaps step in.

🎓Rapid Swaps Explained

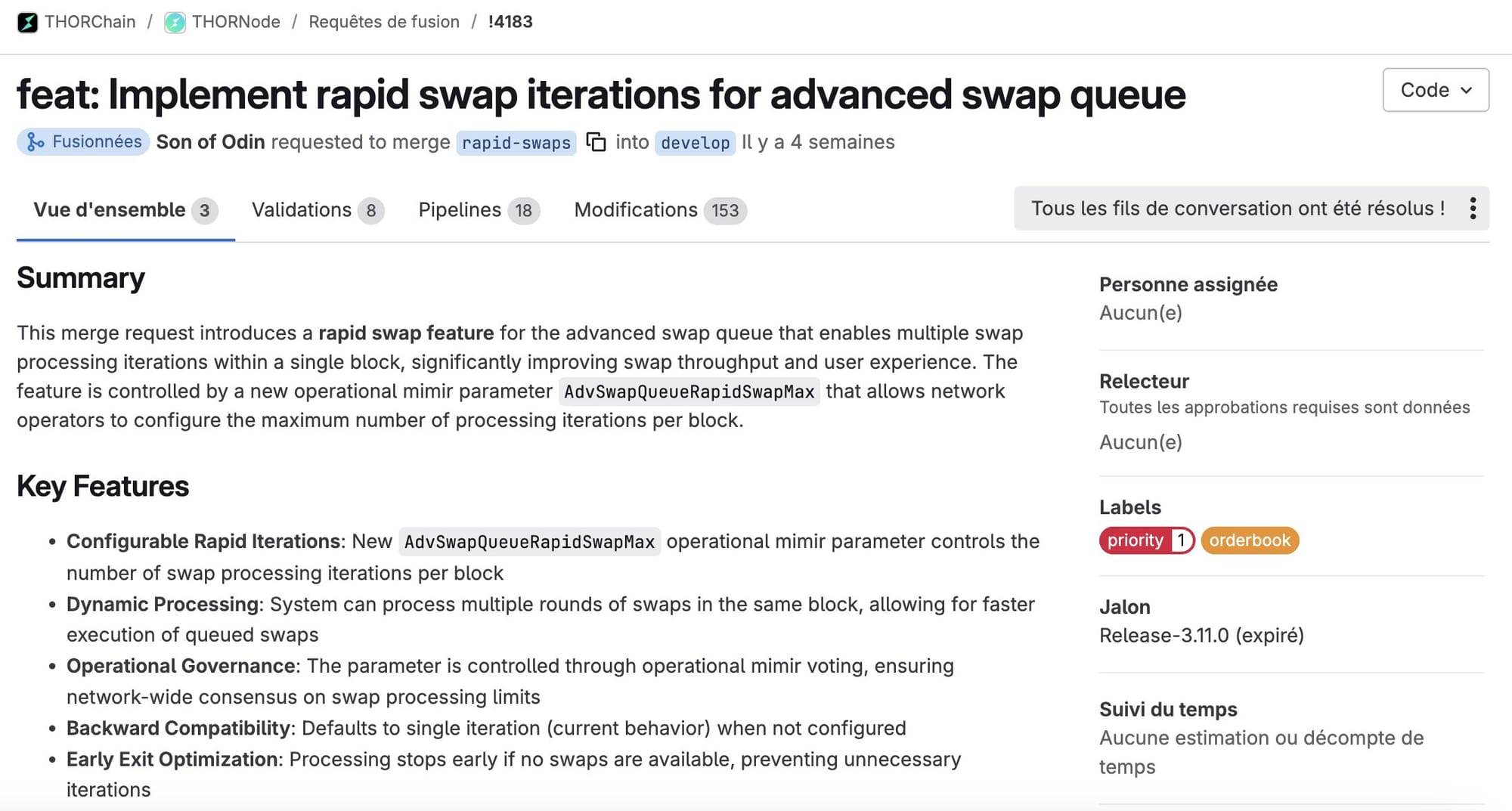

Rapid Swaps are a base-layer enhancement that lets THORChain net out swaps moving in opposite directions within a single block. They allow the protocol to match trades instantly, not just against the liquidity pool.

The core idea is simple:

👉If there are opposite swaps pending in the Advanced Swap Queue, THORChain executes them against each other immediately, instead of treating them separately.

Example for a user's swap:

1️⃣ A user initiates a swap from BTC -> ETH.

2️⃣ The swap enters the Advanced Swap Queue.

3️⃣ THORChain scans the queue for opposite swaps (e.g. ETH -> BTC).

4️⃣ If a counter-swap exists, the trades are netted and settled within the same block.

5️⃣ If only part of the order is matched, the remainder continues streaming as usual, unless it can be netted in the next block.

The impact?

👉 Faster and cheaper swaps, with greater efficiency for the protocol as it can process many more per block, driving higher volume and more fees.

🔁Are Rapid Swaps Replacing Streaming Swaps?

Rapid Swaps are not a replacement for Streaming Swaps, they run in parallel as a fast execution path.

🔸Streaming Swaps

Trades are broken up over time to reduce price impact, allowing pools to rebalance and minimise slippage, especially on large swaps.

🔸Rapid Swaps

Check for active counterparty trades within the same block. If a match is found, the swap executes instantly without waiting for pool adjustments.

The result is faster execution and more competitive pricing, since trades can be matched inside a block rather than waiting for pools to rebalance across blocks.

🤔How Rapid Swaps Impact the Broader Ecosystem

🔹Base Layer Integrators

As Rapid Swaps are implemented at THORChain’s base layer, the feature becomes available to any wallet or DEX that uses THORChain in the backend, from Ledger Live to @RangoExchange or @SwapKitPowered .

The difference lies in how THORChain executes swaps. Instead of executing swaps one by one, it now also looks for matching swaps to net out flows.

🔹App Layer

On the App Layer, Rapid Swaps unlock greater efficiency, making Rujira even more performant. By leveraging the rapid execution mechanism, Rujira can deliver faster, smoother trading across its suite of features, from Spot to Perps and beyond.

🆙A Step Toward THORChain’s "Orderbook"

Rapid Swaps mark more than just a speed upgrade.

👉For traders, they deliver faster execution, tighter pricing, and lower slippage.

👉For arbitrageurs, they open consistent opportunities to capture spreads by matching flows in real time.

👉And for liquidity providers, healthier pools with less churn mean stronger revenue and reduced impermanent loss.

With Limit Orders arriving soon, the combination of Rapid Swaps and Limit Swaps will form the backbone of THORChain’s “orderbook.”

Together, they mark the beginning of a new era, one where THORChain evolves into a more order-driven model, mirroring the efficiency of centralised exchanges while preserving its decentralised, cross-chain foundation. ⚡️