State of the Network - December 2025

Welcome to the first edition of our monthly data series. Each month, we will track the key metrics that define THORChain’s performance, covering security, liquidity, volume, fees, user activity, and supply. The goal is simple: a clear and comprehensive view of the state of the network.

Let’s dive in. ⬇️

1️⃣ Volume and Fees

This month’s volume and fee generation showed alternating periods of lows and spikes. Overall levels were lower than in previous months, which can be explained by three factors:

- Market conditions: The recent market downturn pushed traders to reduce activity.

- Fee experimentation: The fee adjustments led by the Nine Realms team caused natural fluctuations as swap fees were tuned to optimise revenue.

- Technical disruptions: Early implementation issues with Limit Swaps and Rapid Swaps resulted in network halts, delays, and reduced swap efficiency.

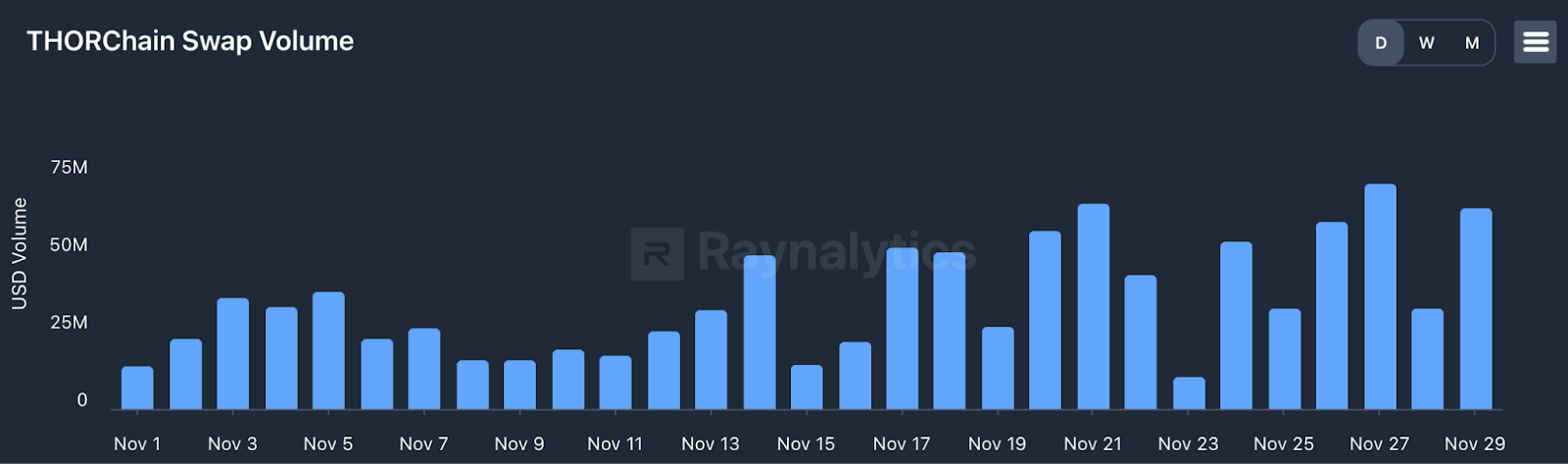

🔹General Volume

The beginning of the month saw low activity averaging $12M per day, but volume accelerated significantly in the second half to get back above the $25M per day mark.

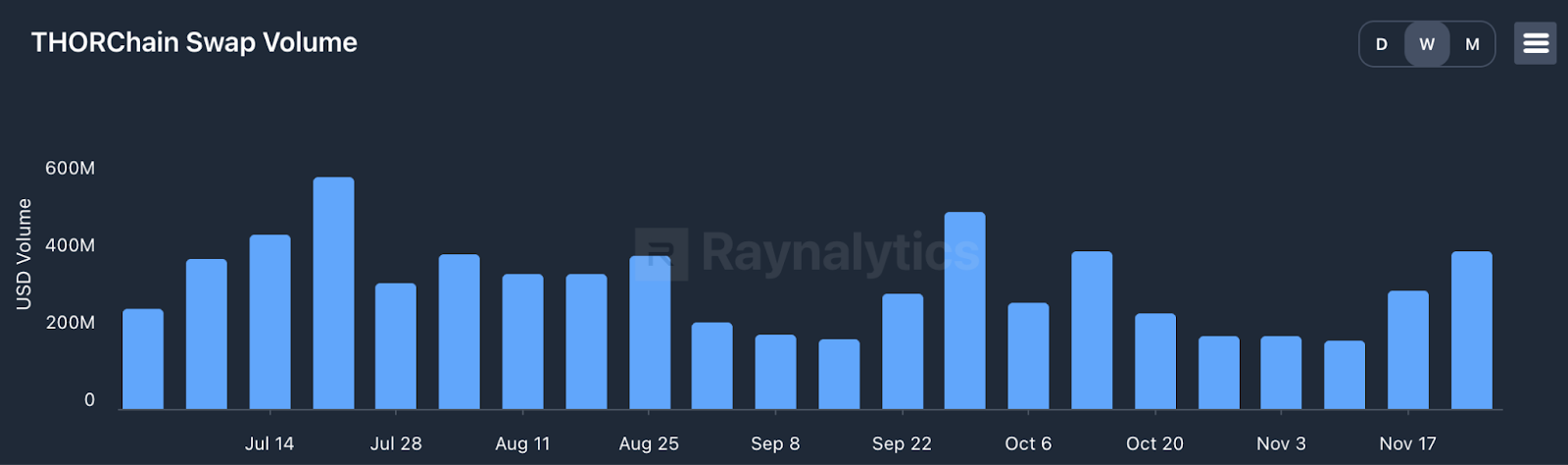

Zooming out on the weekly view across the past six months, volume remains broadly consistent but sits below summer levels, reflecting the combined impact of market conditions, fee experimentation, and recent technical challenges.

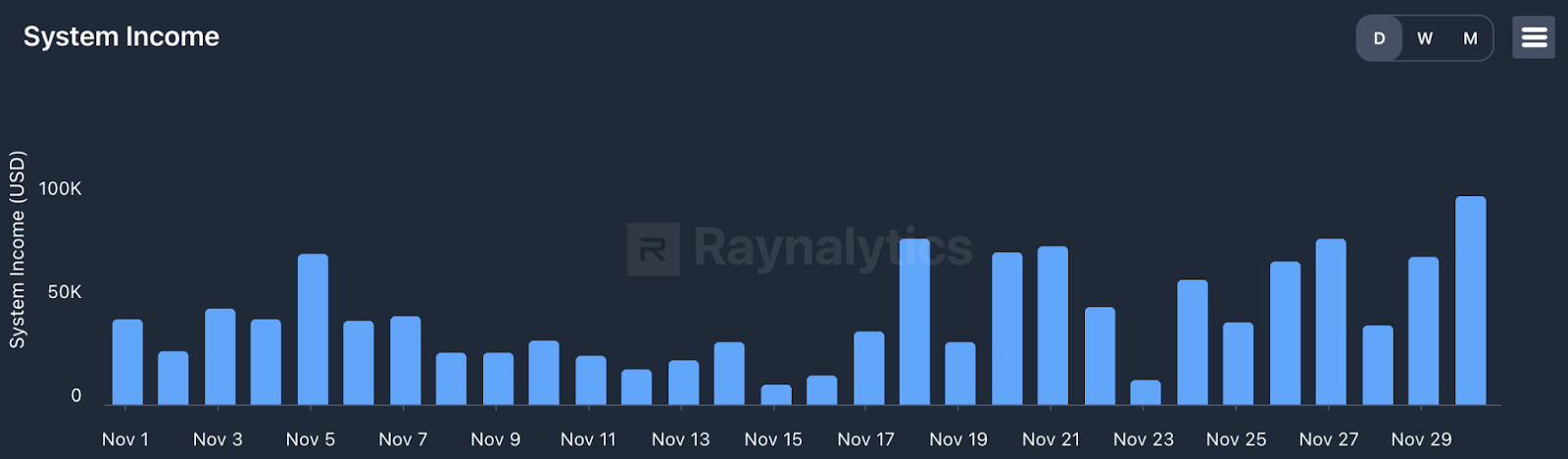

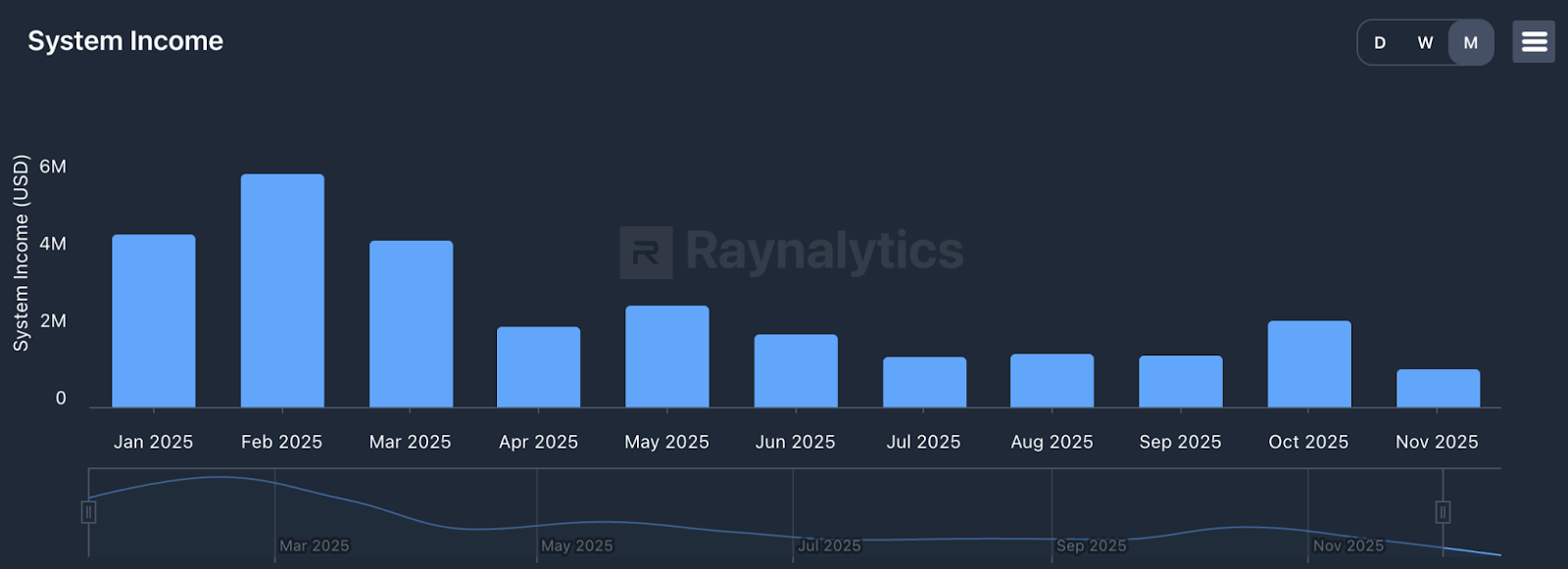

🔹 Fees collected

Fees mirrored the volume trend. Revenue was low early in the month before recovering mid-November. Zooming out, fee generation dropped from roughly $2.2M in October to around $1M in November, with the factors mentioned above being the main drivers.

As the network stabilises again and fee parameters are optimised, fees are likely to pick up.

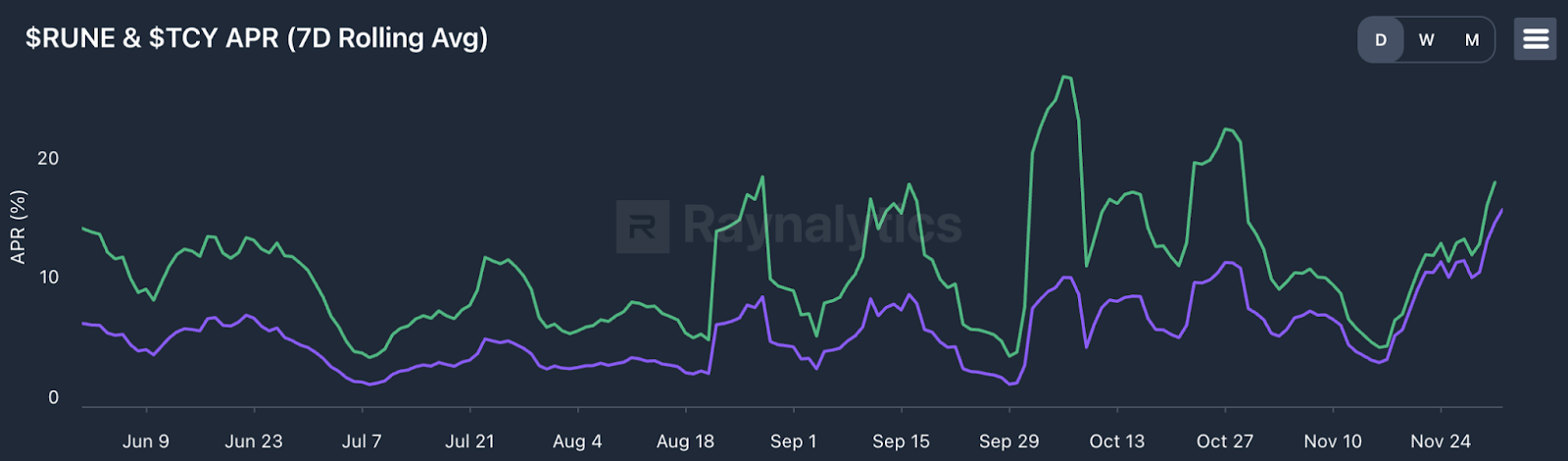

2️⃣ Staked TCY and Bonded RUNE Yield

After the volatility caused by fee experimentation in September and October, and the challenges at the beginning of the month, yields for both bonded RUNE and staked TCY are now back in an uptrend.

Average November yield:

- RUNE: 10.4%

- TCY: 7.9%

Early December yield:

- RUNE: 18%

- TCY: 15%

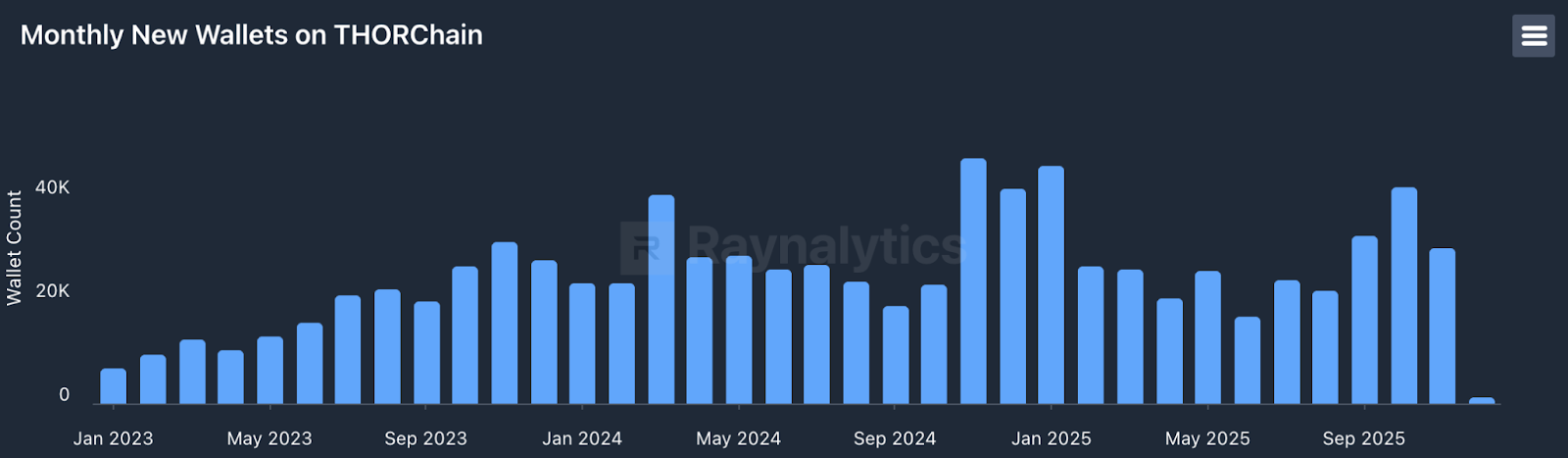

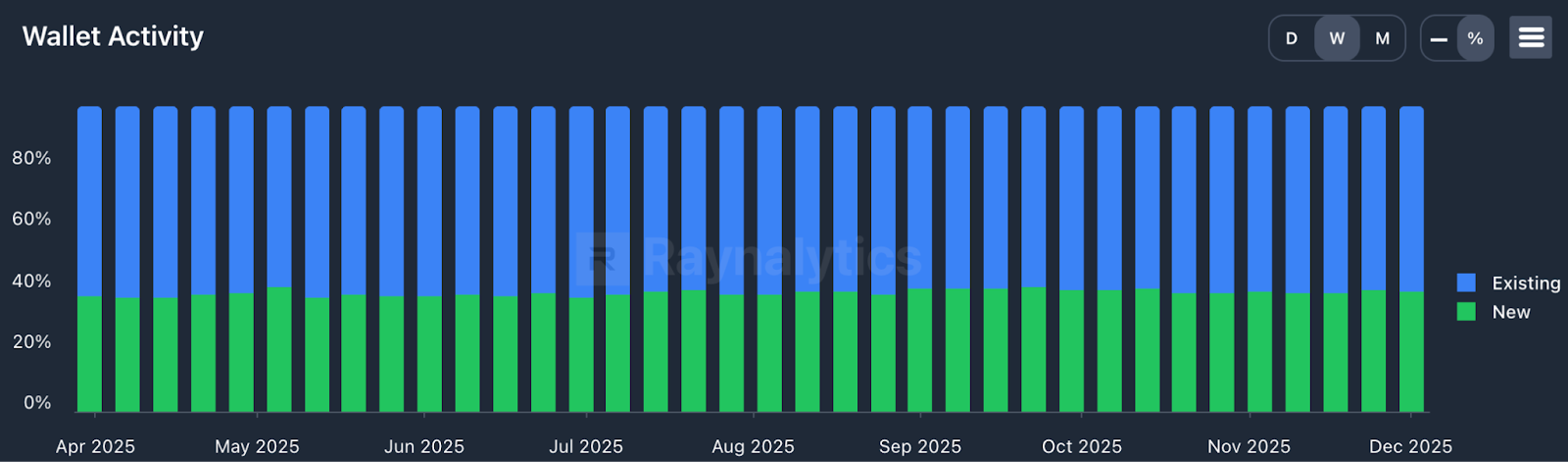

3️⃣ Retention and User Acquisition

Despite lower volume, user growth remains strong. With 29.9k new wallets created in November (down from 41.6k in October, but still above the 2025 average of 28.1k), THORChain continues to convert new users.

Retention remains robust: 60% of swappers are returning users, a level that has remained stable for months. THORChain is attracting new participants while maintaining a loyal base.

4️⃣ Security and Supply

🔹 Bonds

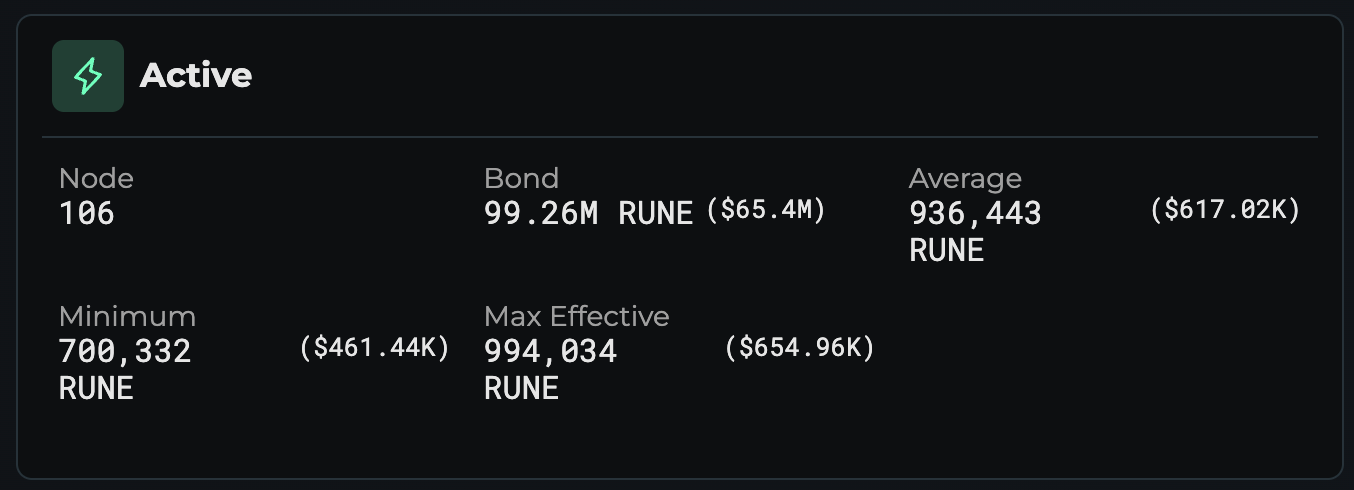

Currently, 106 nodes (maximum possible 120) maintain the network with 99.26M RUNE bonded ($65.4M). The average bond sits at $617k per node, representing substantial capital at risk given the minimum requirement of 700k RUNE ($461k).

🔹 Supply

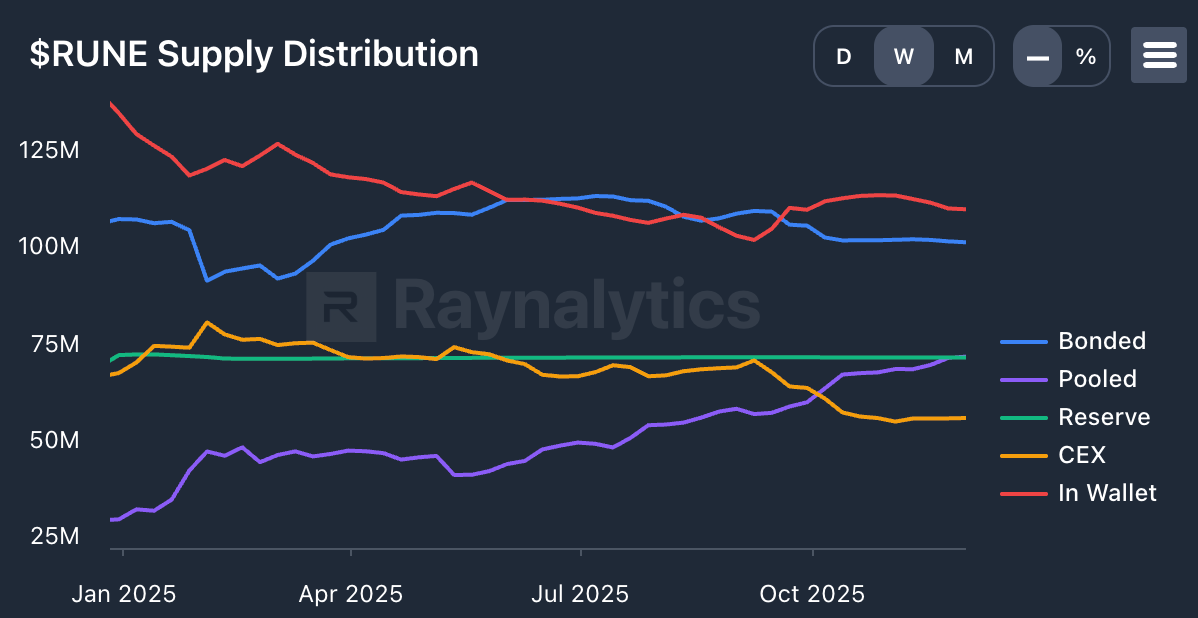

Supply distribution remains structurally strong:

- 24 % bonded

- 18 % in liquidity pools

- 15 % permanently burned

- 14 % held on centralised exchanges

Nearly half of all circulating RUNE is actively securing or powering the network. CEX balances continue trending down as RUNE moves into LP positions and self-custody.

Total RUNE burned to date: $732k, with $54k burned in November. Burns continue steadily without announcements or campaigns, purely the protocol mechanics doing their job.

4️⃣ Frontends

🔹Swapper Acquisition

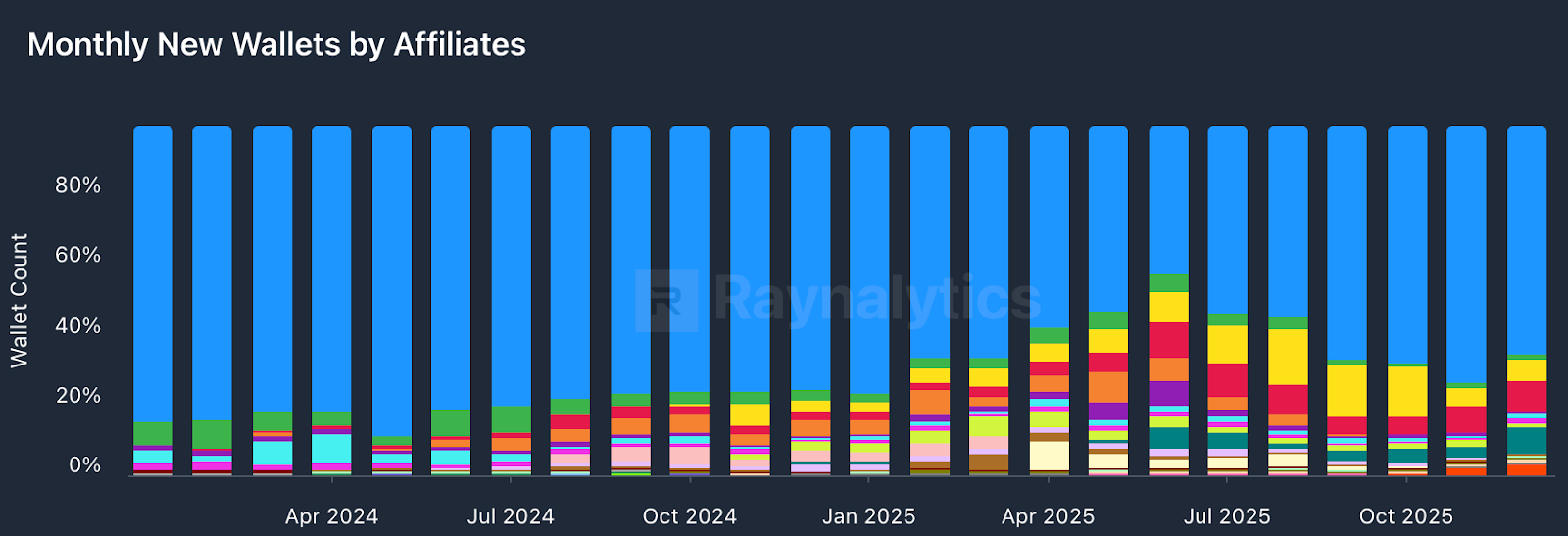

One of the key trends in 2025 has been the growing share of new wallets onboarded through affiliates. While TrustWallet dominated throughout the year, in November the breakdown was as follows: TrustWallet at 65% (blue), Edge Wallet at 8.9% (red), TokenPocket at 7.3 percent (green), Ledger at 6.1% (yellow), and THORChain Swap at 2.9% (orange). The affiliate strategy continues to prove effective in consistently onboarding new users.

🔹Leaderboard by Fees

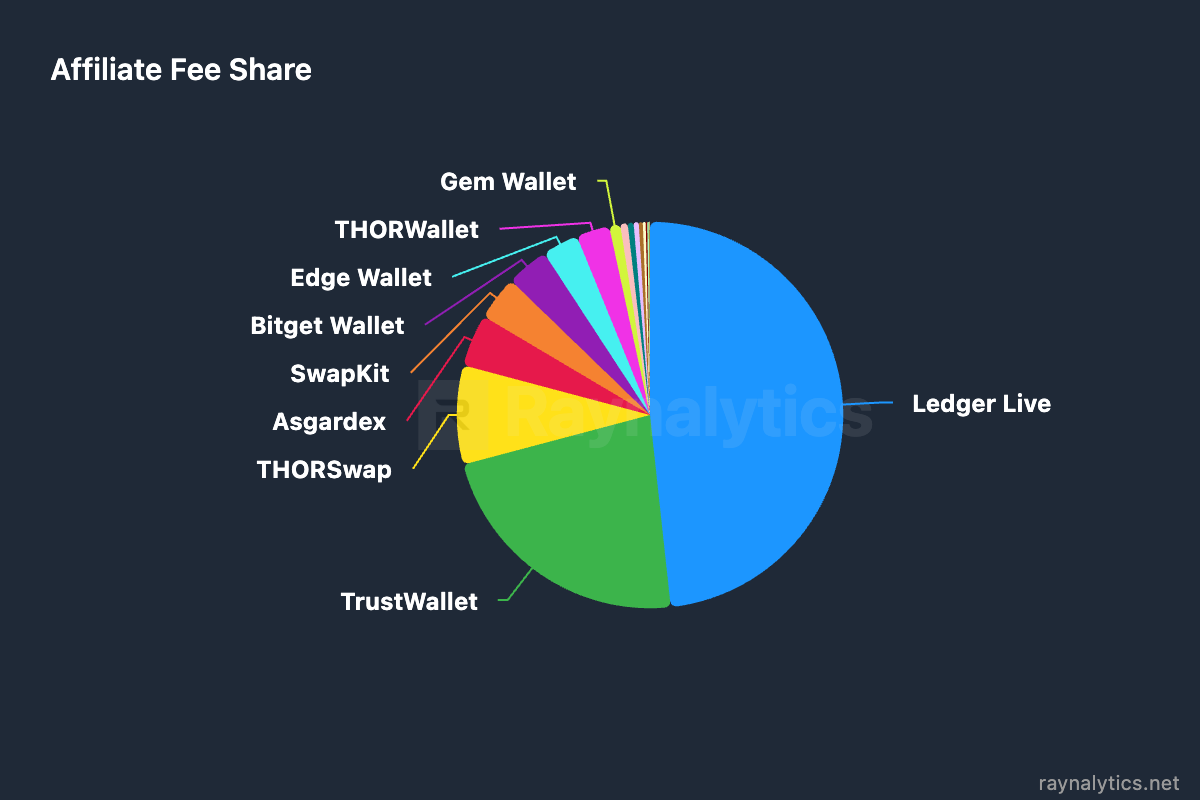

For November, Ledger Live led fee generation with 48.3 percent and $451k collected. It was followed by THORWallet with 22.6% and $211k, and THORSwap with 8.3% and $77.3k. Being a THORChain Affiliate has proven to be a highly lucrative strategy for both DEXs and wallets. To date, affiliates have collectively accumulated $45 million in fees thanks to THORChain.

5️⃣ Key Takeaways

THORChain closed November with solid fundamentals despite market turbulence, fee experiments, and technical challenges. Volume and fees dipped but remained healthy, user acquisition stayed above the yearly average, retention held strong, and yields for both RUNE and TCY moved back into an uptrend. Security remains firm with stable node participation, strong bonding levels, and supply continuing to shift from CEXs into productive use. Affiliates and frontends also reinforced the strength of THORChain’s permissionless design, onboarding users and generating real revenue.

If there are specific metrics or themes you want included in future editions, drop your requests in the comments. We'll add the most relevant ones next month.

Data Sources:

- Raynalitics: https://raynalytics.net/dashboards

- RuneTools: https://rune.tools/

- THORCharts: https://thorcharts.org/

- THORChain Explorer: https://thorchain.net/dashboard