State of the Network - January 2026

Welcome to the January edition. This month, we track security, liquidity, volume, fees, user activity, and supply across THORChain. The goal is simple: a clear and comprehensive view of the state of the network.

⬇️ Let’s dive in. ⬇️

Volume and Fees

December showed contrasting patterns compared to November's subdued performance. The month started with significantly stronger activity before tapering off as the holiday season approached.

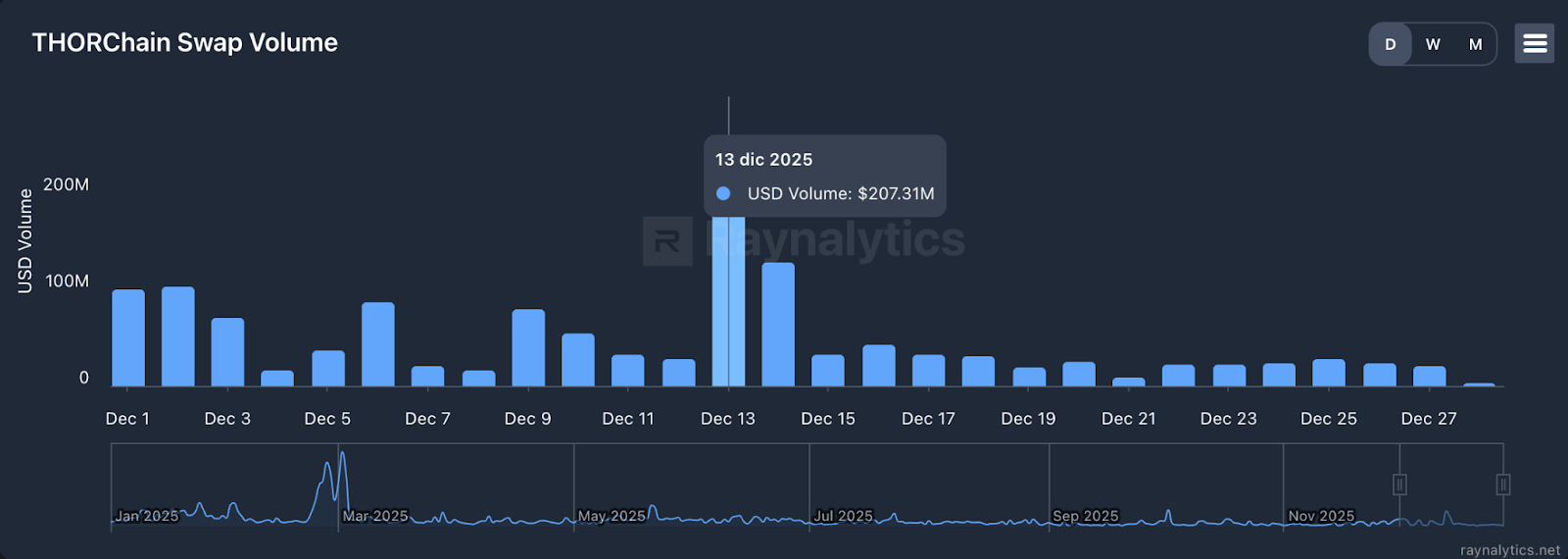

General Volume

The month opened aggressively with consecutive days above $90M (December 1 to 2), signaling renewed market interest after November's challenges. Activity remained solid through mid December, with most days in the $20 to 40M range. The notable spike on December 13th reached nearly $207M, driven partly by a single user who contributed approximately $40M in $BTC to $ETH swaps, demonstrating the protocol's capacity to handle concentrated high value activity alongside regular volume.

However, volume declined sharply as Christmas approached, with December 23 dropping below $10M daily, classic bahaviour during this period of the year.

Fees collected

Fee generation mirrored volume patterns throughout December, with strong early performance followed by holiday slowdown.

The month opened with robust fee collection: December 1-2 generated over $100K daily in system income, matching the elevated swap volume during this period. The mid-month spike on December 13th pushed daily fees above $217K, the highest single-day revenue of the month. This coincided with the concentrated high-value swapping activity, demonstrating how large transactions contribute significantly to protocol revenue.

After mid-December, fees declined steadily as volume tapered off. The Christmas period saw daily system income drop around the $25K, reflecting the minimal trading activity.

$TCY and $RUNE Yield

Yield performance in December reflected the month's volume patterns, with strong early returns before declining as holiday trading activity dropped off.

The correlation between yields and trading activity is stark. When volume surges, fees increase, and returns for both node operators and $TCY holders rise proportionally. Conversely, when markets go quiet, whether due to holidays, macro uncertainty, or seasonal effects, yields compress immediately since both are entirely dependent on swap fee generation.

Mid-December spike yield:

- $RUNE: 22.07%

- $TCY: 17.13%

$RUNE APR over the last 30D: 14.48%

Retention and User Acquisition

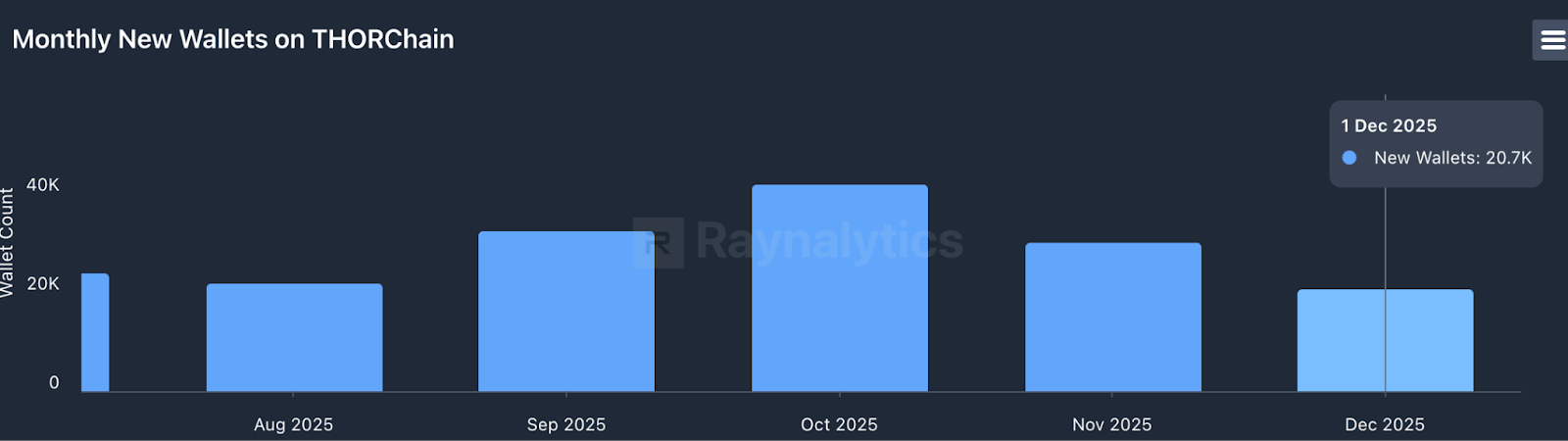

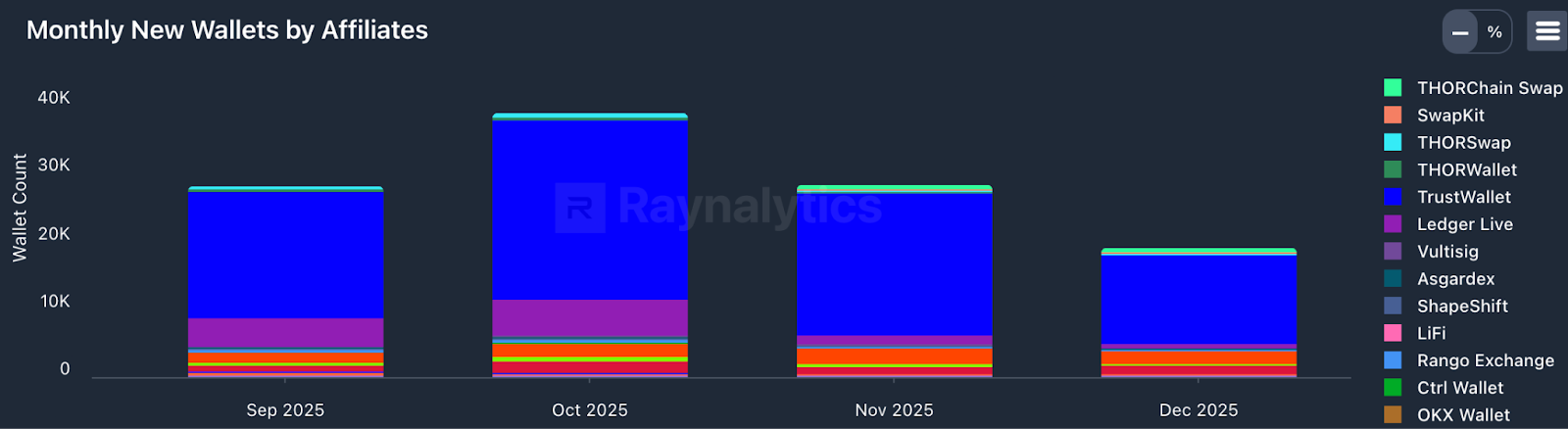

New wallet creation dropped to approximately 21K in December, down from 30K in November. The December slowdown aligns with reduced overall trading activity, particularly in the second half of the month as the holiday season took hold.

December's retention metrics remained remarkably stable despite the volume decline. Throughout the month, returning users (blue) consistently represented 40-45% of daily wallet activity, with new wallets (green) comprising 55-60%. This ratio held steady even during the holiday slowdown in late December, when overall wallet count dropped but the new-to-existing split barely changed.

Security and Supply

Bonds

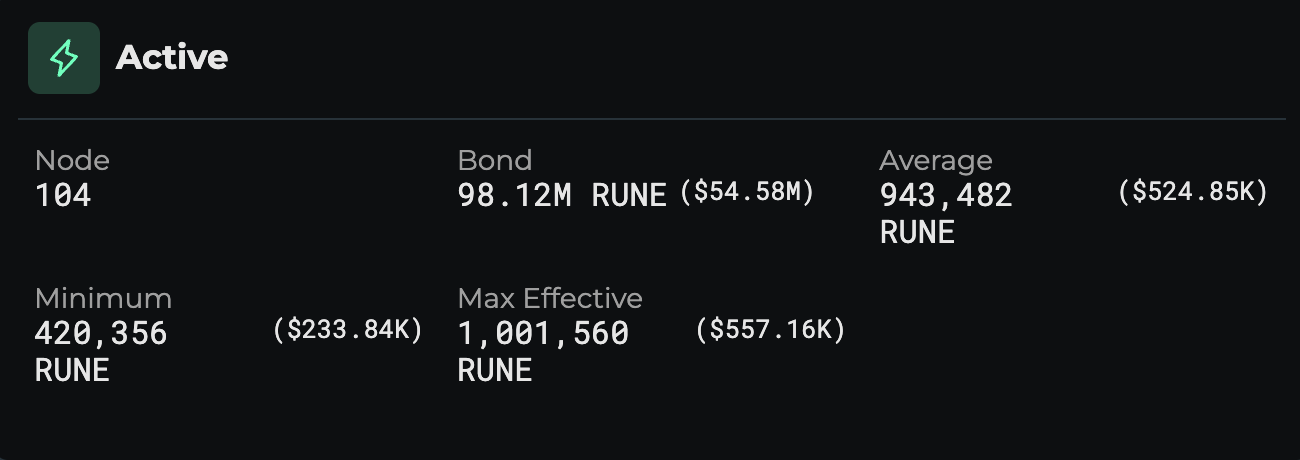

Node participation contracted slightly in December, dropping from 106 active nodes in November to 104 by month's end. Total bonded capital decreased correspondingly from 99.26M $RUNE ($65.4M) to 98M $RUNE ($54.58M), reflecting both the reduction in node count and $RUNE's price decline during the period.

The two-node reduction represents normal network dynamics rather than a concerning trend. With a maximum capacity of 120 nodes, the network operates well within healthy parameters at 104 active participants. Node operators continue maintaining substantial capital at risk; over $500k on average, ensuring economic security remains robust despite the slight contraction.

Supply

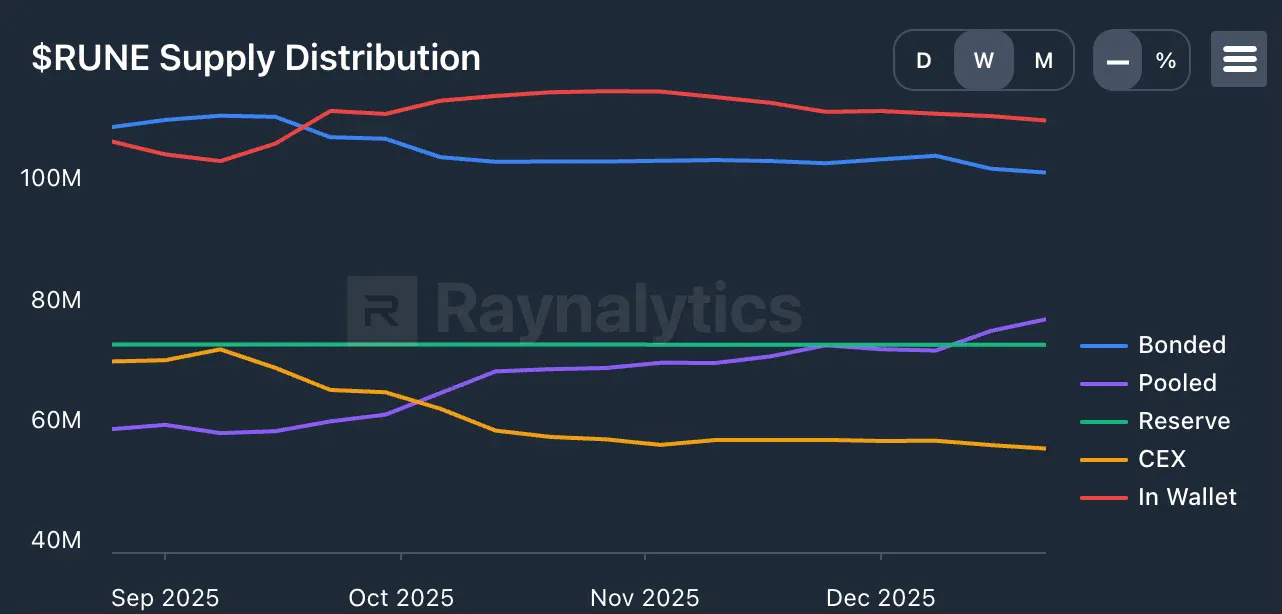

Supply distribution remains structurally strong:

- 24 % bonded

- 18 % in liquidity pools

- 15 % permanently burned

- 13 % held on centralised exchanges

December's supply distribution showed continued healthy trends, with $RUNE flowing from centralized exchanges into productive protocol usage.

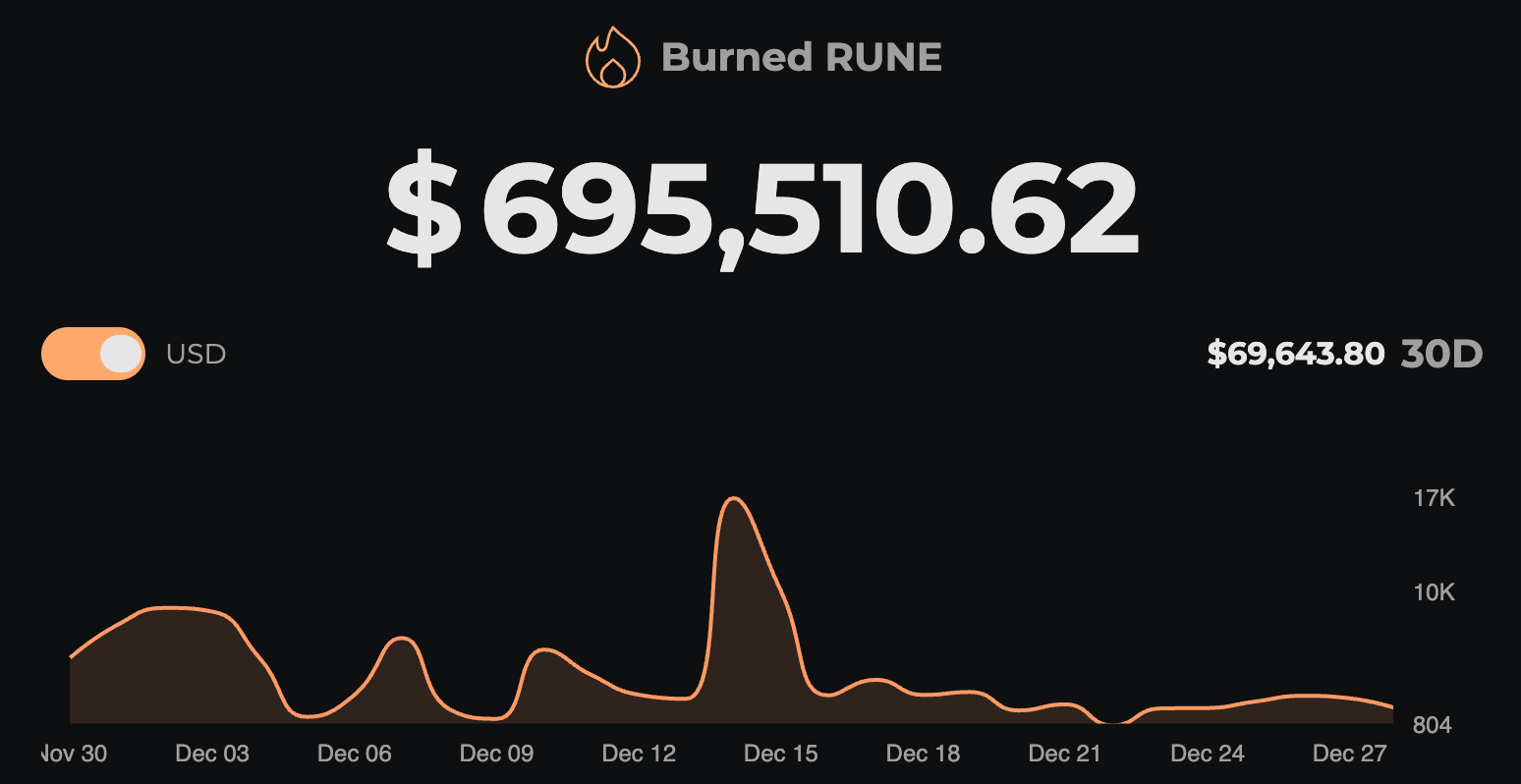

Total $RUNE burned to date: $695k, with $70k burned in November. Burns continue steadily without announcements or campaigns, purely the protocol mechanics doing their job.

Frontends

Swapper Acquisition

TrustWallet continued dominating new user onboarding in December, bringing 13.2K new wallets. Representing approximately 66% of that month's acquisition. Edge Wallet followed with 1.9K new users (9.5%), Token Pocket with 1.3K (6.5%), Ledger Live with 598 (3%), and THORChain Swap with 575 (2.9%). The affiliate model proves highly effective for onboarding, but success remains heavily concentrated in platforms with large existing user bases and seamless swap integrations.

Leaderboard by Fees

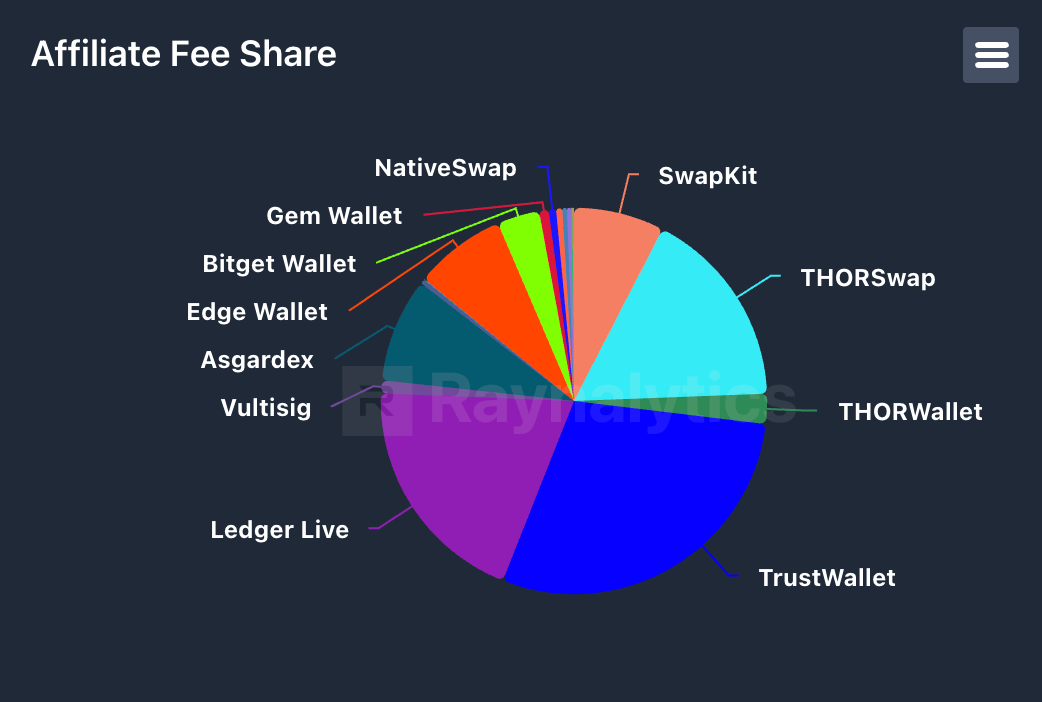

December's affiliate fee distribution became significantly more balanced compared to November's concentrated leadership.

TrustWallet emerged as the top earner with approximately 30% of affiliate fees, while Ledger Live dropped from November's dominant 48.3% to roughly 20% of December's total. THORWallet maintained around 15 to 20%, down slightly from November's 22.6%. THORSwap captured approximately 15 to 20%, up considerably from November's 8.3%.

The redistribution reflects changing user behaviour during the holiday period, with hardware wallet users potentially less active while mobile platforms maintained stronger engagement. The competitive landscape demonstrates the permissionless affiliate model working as intended, with market share shifting based on genuine platform performance.

Being a THORChain affiliate remains highly lucrative for both DEXs and wallets, with the ecosystem having collectively accumulated over $45 million in fees to date.

Key Takeaways

THORChain closed December with resilient fundamentals amid a strong start followed by holiday-driven slowdowns. Volume and fees began robustly with multi-day highs but tapered off toward Christmas, while user acquisition declined slightly yet retention remained consistently strong at 40-45% returning users. Yields for both $RUNE and $TCY followed volume trends, peaking mid-month before compressing, with $RUNE at 14.48% over the last 30 days.

Security held firm despite minor node contraction, maintaining substantial bonding levels, and supply distribution strengthened with continued shifts from CEXs into productive use, including steady burns. Affiliates and frontends demonstrated the permissionless model's effectiveness.

If there are specific metrics or themes you want included in future editions, drop your requests in the comments. We'll add the most relevant ones next month.

Data Sources: RUNETools, THORCharts, THORChain Explorer, Raynalitics