THORChain Tokenomics (as of Oct 2025)

Over the years, $RUNE tokenomics have evolved massively. In the early days there were investors, unlock schedules, and block rewards. Then came THORFi with Lending and Savers, followed by the end of block rewards, burn dynamics through ADR12, and now TCY token since THORFi sunset.

It’s no surprise that many still ask the same questions: should we expect unlocks? What’s the real circulating supply? How do fees actually flow through THORChain? Is there still inflation?

Time to set the record straight and get a clear understanding of how RUNE works today.

🌰IN A NUTSHELL

You might have explored RUNE tokenomics a long time ago, or you might already be a seasoned Chad. Either way, here are the key mythbusters that re-establish the truth:

▫️Using THORChain for swaps does not require holding RUNE or paying gas fees in RUNE.

▫️Block Rewards ended in early 2025, meaning all rewards for nodes, LPs, and other stakeholders now come from real organic activity.

▫️THORFi (Lending and Savers) has been sunset. There is no leverage on base-layer liquidity anymore. Instead, the situation (described later) was resolved through $TCY, a token that grants holders a share of fees.

▫️Total Supply has been reduced over time to 425M, with ~350M circulating. The reserve is not intended to be used, so actual supply today is around 350M, decreasing daily through burns.

▫️Circular loop: fees collected are swapped into RUNE, then distributed to the network, creating a neutral economic loop (if we set timing of actions aside).

▫️Unlocks are over. There are no investors or tokens waiting to be released.

⚙️RUNE USED FOR LIQUIDITY & SECURITY

Unlike many protocols, RUNE is central to both liquidity and security.

💧LIQUIDITY💧

For liquidity, RUNE acts as the common medium across all pools. Every pool is structured 50:50 with half native asset (BTC, ETH, XRP, USDC, etc.) and half RUNE. This ensures interoperability between pools and removes reliance on external tokens like USDC, which can carry centralisation and censorship risk.

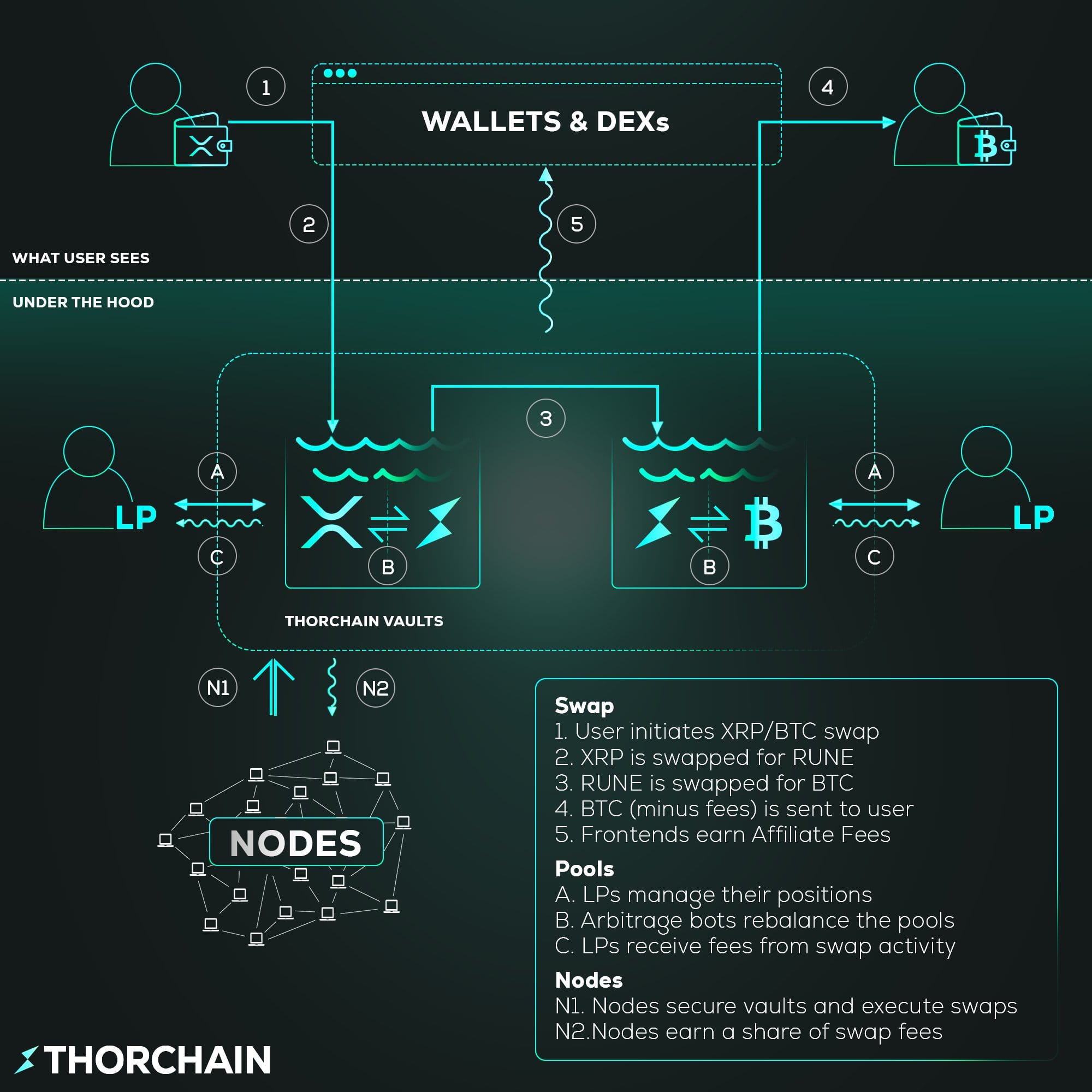

The best way to conceptualise a swap on THORChain is to view it through this simplified four-step process, using a BTC -> ETH swap as an example:

- BTC is added to the BTC/RUNE pool.

- The pool becomes unbalanced, with too much BTC and not enough RUNE.

- RUNE flows in from the ETH/RUNE pool to restore balance.

- This leaves excess ETH in the ETH/RUNE pool, which is then sent to the user.

That’s the basic swap logic using the liquidity pools on THORChain. However liquidity needs to be secured, which is where Nodes come in.

🔒SECURITY🔒

On most chains, liquidity is secured by the network’s native asset. For example, on Ethereum, ETH ensures the security of the entire network, including its liquidity. THORChain works in a similar way, with RUNE taking on that role.

Nodes must bond RUNE (~staking) to the protocol, and security follows a simple but effective principle: the value bonded must always be greater than the liquidity pooled.

Originally, the logic was straightforward: $1 of native assets paired with $1 of RUNE in the pools would be secured by $2 of RUNE bonded. This created the well-known 1:3 ratio among Chads. More recently, updates have introduced more flexibility in the security design to improve capital efficiency adjusting this ratio with more flexibility.

👉However the principle remains the same: liquidity is secured by bonded capital.

⚖️ THE INCENTIVE PENDULUM

Now that we understand the principles of security and liquidity, the next question is: how do we ensure the balance between the two is maintained? Nodes may choose to leave the network, creating a deficit in security, while LPs can add more assets, tipping the system toward excess liquidity without sufficient protection.

Unlike many protocols where this would be handled through manual governance, THORChain has decided to trust code.

👉And that’s where the Incentive Pendulum comes in.

The Incentive Pendulum distributes rewards between nodes and LPs based not only on their contributions but also on the needs of the network. If the system is overbonded (too much security), rewards shift toward liquidity providers. If it’s underbonded (not enough security), rewards are directed to nodes.This automatic balancing ensures that security and liquidity remain aligned without human interference, keeping the system stable and funds safe.

💰WHERE DOES THE YIELD COME FROM?

As mentioned above, rewards are distributed to nodes and LPs. And naturally the main question is “Where does the yield come from?”

👉The answer is simple: fees.

THORChain no longer relies on inflation or artificial incentives. Like many protocols in their early stages, it once used block rewards (incentives) to bootstrap activity. But with the network’s rapid growth in recent years, those rewards were switched off entirely in February 2025.

👉Today, RUNE is no longer inflationary.

All rewards distributed to stakeholders come from real usage, primarily swaps executed by real users. These can happen directly on THORChain, through affiliates such as Ledger, TrustWallet, or Bitget Wallet, or via trading activity on the app layer @RujiraNetwork .

Note: while swap fees make up the bulk of rewards, there are also minor fees such as network transfer fees within the THORChain ecosystem.

🔄FEE DISTRIBUTION

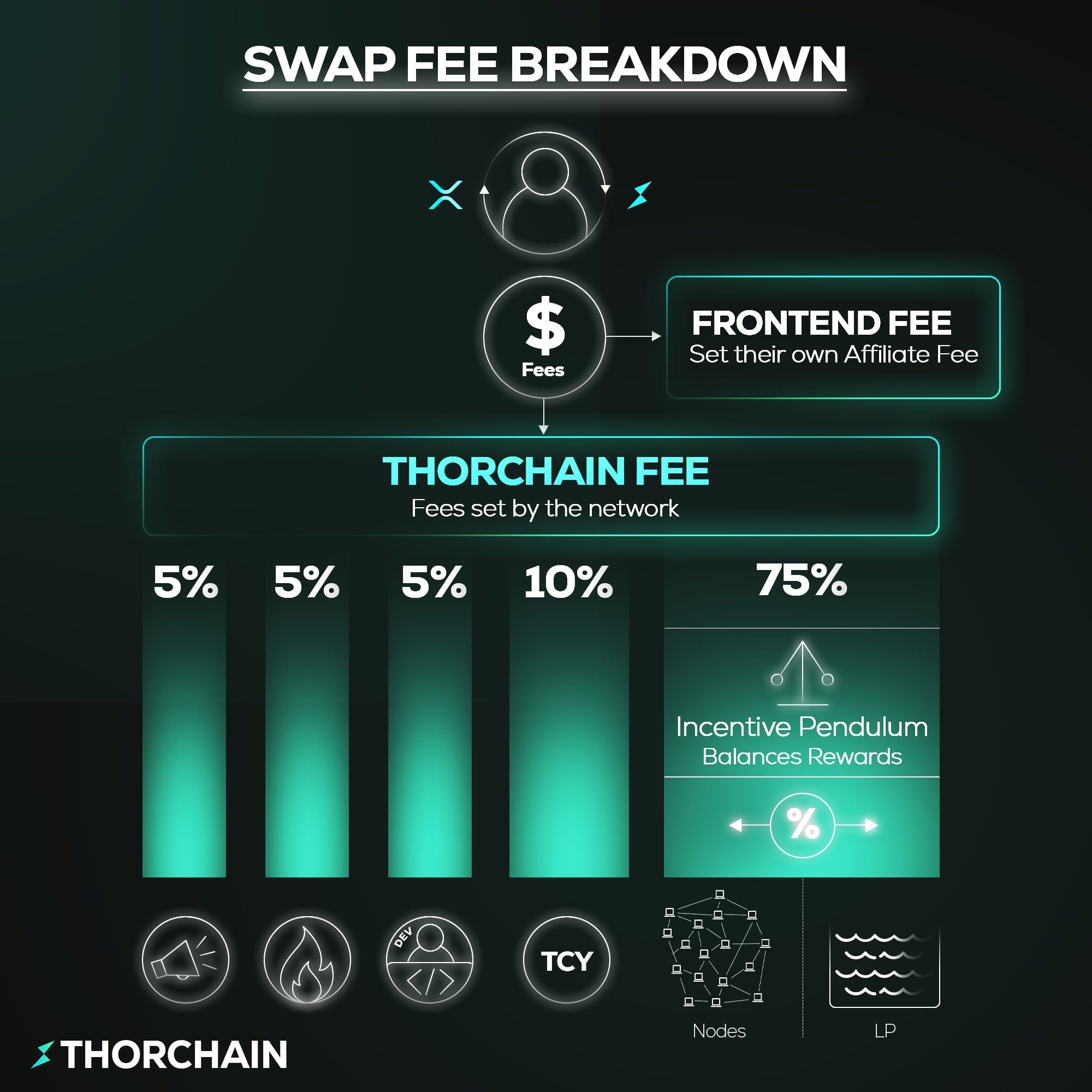

When a user makes a swap, they pay fees in the native assets being traded. The amount depends on the swap size and the minimum fee set by the network. These fees are then converted into RUNE and distributed as follows:

🔸5% is burnt.

🔸5% goes to the marketing fund (introduced in September 2025 via ADR020).

🔸5% goes to the dev wallet to support ongoing development.

🔸10% is distributed to $TCY holders (a mechanism introduced after the THORFi sunset).

🔸75% is distributed to nodes and LPs according to the Incentive Pendulum.

Note: Fees collected on THORChain are separate from affiliate fees, which are frontend charges applied by wallets and DEXs such as Ledger or TrustWallet.

Note: RUNE operates in a circular economy. Some may raise concerns about selling pressure from the dev wallet, node rewards, or the marketing fund. While selling by these stakeholders can’t be avoided, it’s important to note that all RUNE distributed to them originates from fees collected in RUNE or swapped into RUNE (creating buying pressure). Timing aside, this makes the system neutral.

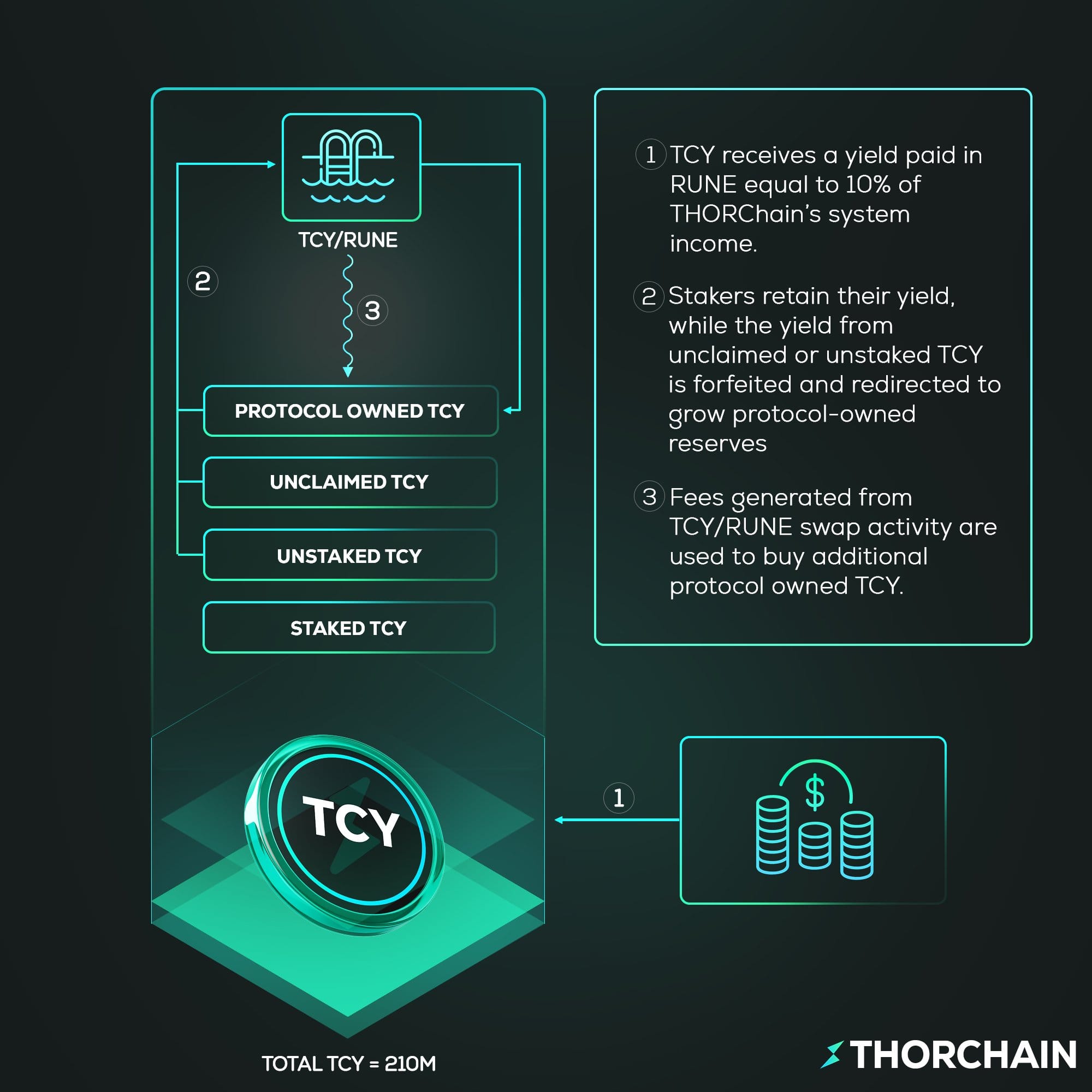

🪙 WHAT IS TCY?

$TCY is a token that grants holders a share of protocol revenue when staked. It was launched in March 2025 following the sunset of THORFi.

THORFi was THORChain’s first iteration of DeFi, launched at a time when the broader DeFi ecosystem was still developing. It introduced features like Lending and Savers, which deepened liquidity and boosted usage. However, over time, THORFi became too risky to maintain for the protocol and had to be shut down in early 2025.

This meant users couldn’t withdraw their funds from Savers or Lending. To provide a long-term solution, the network leveraged THORChain’s fee revenue by introducing a new token, $TCY, which entitles holders to a share of protocol fees:

🔹$TCY circulating supply is 210M.

🔹$TCY total supply is 210M.

🔹$TCY max supply is 210M.

🔹$TCY stakers get 10% of protocol revenue paid in RUNE on a daily basis.

🔹$TCY was distributed to users who were unable to recover their funds when THORFi was sunset and is now a tradable asset.

📊CURRENT SUPPLY

With all these changes, it’s important to outline the current supply of RUNE: what’s circulating, what has been burnt, and how the numbers add up.

The initial supply was 500M RUNE. From this:

🔹13.9M were “killed” (tokens not migrated from BEP2 to Native).

🔹60M were burnt during ADR012 (needed for Lending).

🔹0.9M RUNE from collected fees were burnt through the 5% burn mechanism.

Consequently, the max supply today stands at 425.3M RUNE. However, not all the supply is circulating:

🔹71.2M sit in the reserve (no longer used since block rewards ended).

🔹2.9M used in POL from the THORFi era.

👉This leaves 351.2M RUNE circulating and actively used as of 1 October.

The supply will continue to shrink over time as ongoing burns remove more from circulation.

Note: there are no more unlocks. All assets have been distributed, and investors are fully vested.Source:

👑 A WORD ON GOVERNANCE

THORChain’s governance model often surprises newcomers. Unlike many systems, holding or bonding more RUNE does not give you extra power. A node bonding 900k RUNE and another bonding 1.2M RUNE each hold the same voting weight: one vote.

👉All nodes have equal weight, regardless of how much RUNE they bond.

Nodes can vote on three main types of decisions:

🔹Mimir (constants): adjustments to THORChain’s parameters.

🔹Protocol upgrades: significant improvements that introduce new features and require nodes to update their stack.

🔹ADRs (Architectural Decision Records): major changes that impact the overall architecture of THORChain.

👉Voting is generally not time-sensitive. For example, a Mimir takes effect as soon as 67% of nodes vote in favour.

Delegation is possible, but only under terms set by each node (such as fees or withdrawal conditions). Delegators do not vote directly, but they may have a say if the node operator allows it.

Note: This is a simplified overview of delegation and Mimirs. Some nuances are not covered here in order to keep the explanation easy to digest.

💭CLOSING REMARKS

THORChain’s tokenomics have evolved from an inflationary bootstrap model into a lean, self-sustaining system powered entirely by real usage.

With no unlocks remaining, block rewards switched off, and ongoing burns steadily reducing supply, RUNE’s economics are now both sustainable and deflationary. ⚡️