When Your Money Is Not Really Yours

When I look at my timeline I notice that many of the discussions about crypto and the technologies we are building are unfortunately driven by price. Charts, cycles, hype, and the endless noise of who is winning and who is losing this week.

That surface conversation is loud and it dominates both X and LinkedIn, but price is not the point. I have spent years building in this space for reasons that have very little to do with numbers going up and everything to do with something more basic. Whether your ability to hold and move your money is a right or merely a permission that can be taken away.

If you have always lived in a relatively stable country with a functioning banking system, that distinction may be easy to miss. Your card works, your balance is there, and you do not worry about your assets being frozen or seized.

It feels natural to assume that your money is truly yours because you have never had that assumption challenged. History tells a different story. What most people experience as ownership is often just participation in a system that grants access only as long as it agrees with you.

That is the foundation of everything I care about in crypto, and in this article I will explain why bringing the focus back to this matters.

What I Mean When I Say Price Is Not the Point

The easiest way to understand what I am talking about is to look at money through the lens of inalienable human rights. Think about freedom of speech, freedom of assembly, and due process. These rights matter and they are worth protecting. Historically, however, they do not exist on their own. They exist because governments grant them, define them, and enforce them.

When you apply the same logic to money, you begin to realize that financial freedom and money itself are even more fragile, and they are not rights in the same sense. When interacting with fiat currency, you are simply operating inside an institutional framework. Your bank account is not something you truly own. It is an entry in someone else’s database, with regulations and laws offering some protection over that ownership. History has shown that when systems start to break, it becomes obvious that those protections are far weaker than most people assume.

In 2013, during the Cyprus banking crisis, this became impossible to ignore. To stabilize the banking system, the government forced losses onto ordinary depositors, requiring accounts holding more than one hundred thousand euros to take a haircut, meaning a portion of people’s savings was simply taken.

What made the situation even more revealing was how deliberately it was handled. The decision was announced on Saturday, March 25, just before a national holiday and in the middle of a carnival weekend, when banks were already closed and public attention was elsewhere. By the time branches reopened days later, depositors had no real opportunity to protect themselves or access their money.

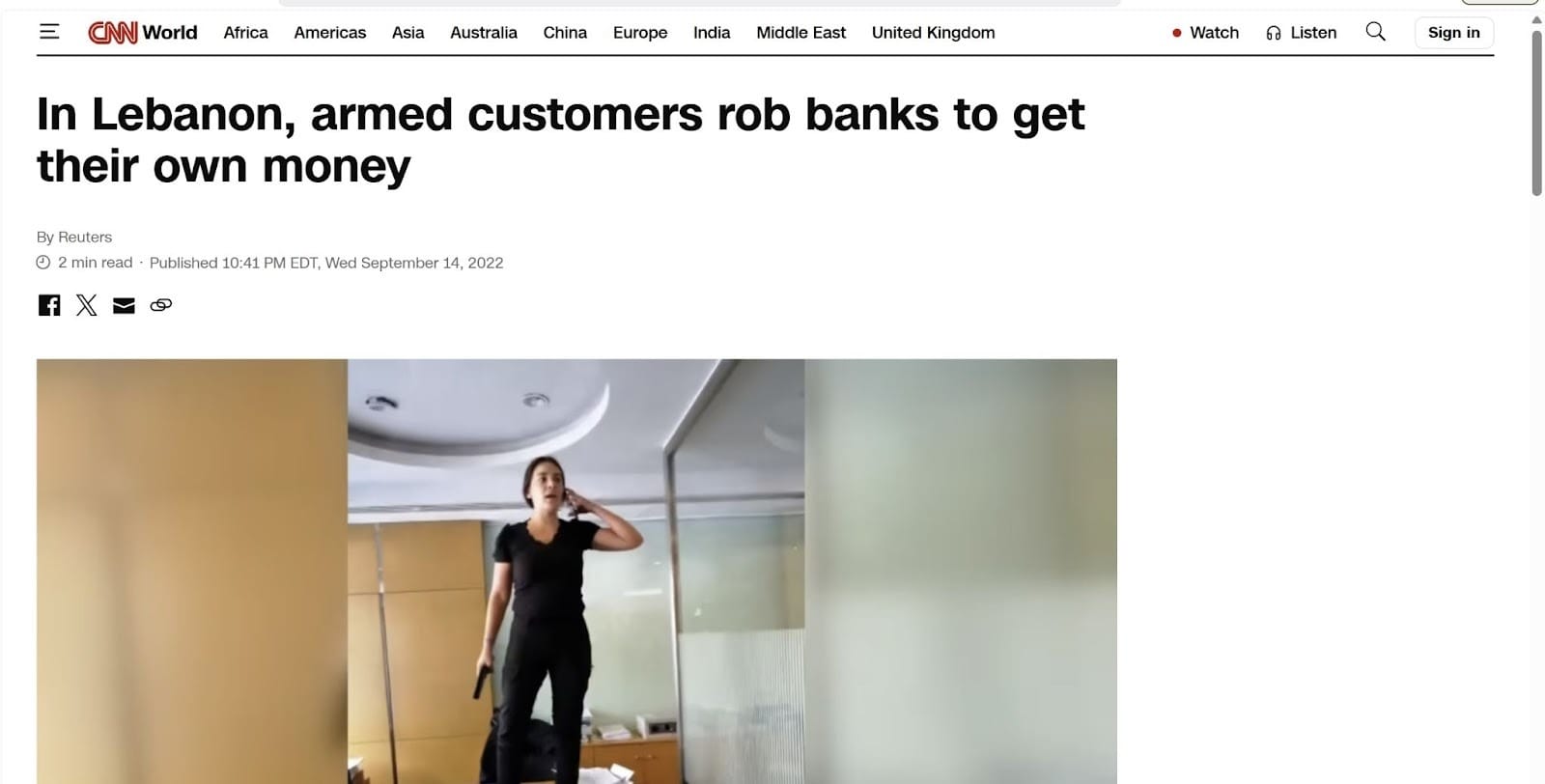

Or if you prefer a more recent example, we can look at what happened in Lebanon. When the financial system started to collapse, banks simply stopped allowing people to access their money. Withdrawal limits appeared, and most people were told to wait. This situation became so dire that at one point a few depositors ended up walking into their banks and robbing them to get their funds back.

And while reading this, you might think this could never happen to you, especially if you live in the West and consider it a safe place. But even in countries people see as stable, the same levers exist. During the Canadian trucker protests, bank accounts were frozen and people were debanked for political reasons. Regardless of how anyone feels about that situation, it revealed something important. Financial access is a control mechanism. It can be turned on and off, and regardless of where you live, there is always a chance that becomes reality.

And just to be clear, I do think there are situations where freezing funds makes sense. If you are dealing with criminals or terrorists who directly harm society, it is reasonable to use those tools.

The problem is that once the ability to freeze funds and seize assets exists, someone has to decide how and when it is used. Humans are not perfect. Mistakes happen, and power is often misused. You cannot fix a problem like that by pretending it will not happen, especially when time and time again we have seen these powers abused.

The only way to reduce that risk is to design systems where no single group gets to decide who can and cannot participate.

That is why Bitcoin was such a breakthrough in 2008. For the first time in history, mathematics created something that functioned like a right. A person anywhere in the world could hold value in a self sovereign asset that could not be confiscated, frozen, or revoked by even the most powerful government. Not because of a law or a policy, but because cryptography made it structurally difficult to interfere.

Bitcoin Gave Us Storage. Movement Came Later.

Bitcoin solved the problem of self sovereign storage of value. It allowed millions of people to be their own bank. One problem, however, is that as the crypto space grew and more blockchains were built and more assets were created, Bitcoin had not solved one thing. The self sovereign movement of value between those assets and blockchains. And that missing piece matters just as much.

For years, if you wanted to move from Bitcoin to Ethereum, or from Ethereum to anything else, you had to go through centralized exchanges. Binance. Coinbase. Kraken. Pick your platform. They provided real utility, but they also recreated the same choke points that crypto was supposed to remove.

Custody, KYC, account freezes, withdrawal limits, and policy changes. With these centralized exchanges, the industry essentially rebuilt many of the same issues that exist in the traditional financial system.

This setup is what made me, and a lot of other people in the industry, start asking a simple question. How do you exchange assets between arbitrary blockchains without surrendering custody and without trusting intermediaries that can fail, censor, or be captured. That question is what eventually led to THORChain.

It was built to solve exactly that problem. It became the first protocol to create decentralized cross chain liquidity, meaning you can exchange assets across different blockchains without giving up your keys and without inserting a centralized gatekeeper into the process.

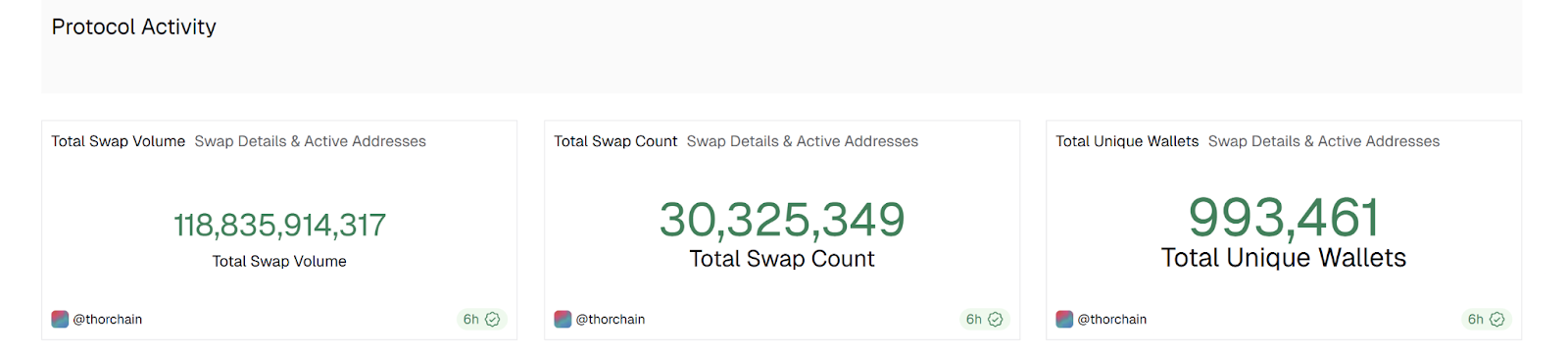

And today, it is powerful to see what that idea has become. THORChain has now processed over 118 billion in total swap volume across more than 30 million swaps, with nearly one million unique wallets using the protocol.

What We Should Actually Be Talking About

So if I am going to complain about the conversation being too focused on price, it is only fair to also say what I think it should be about.

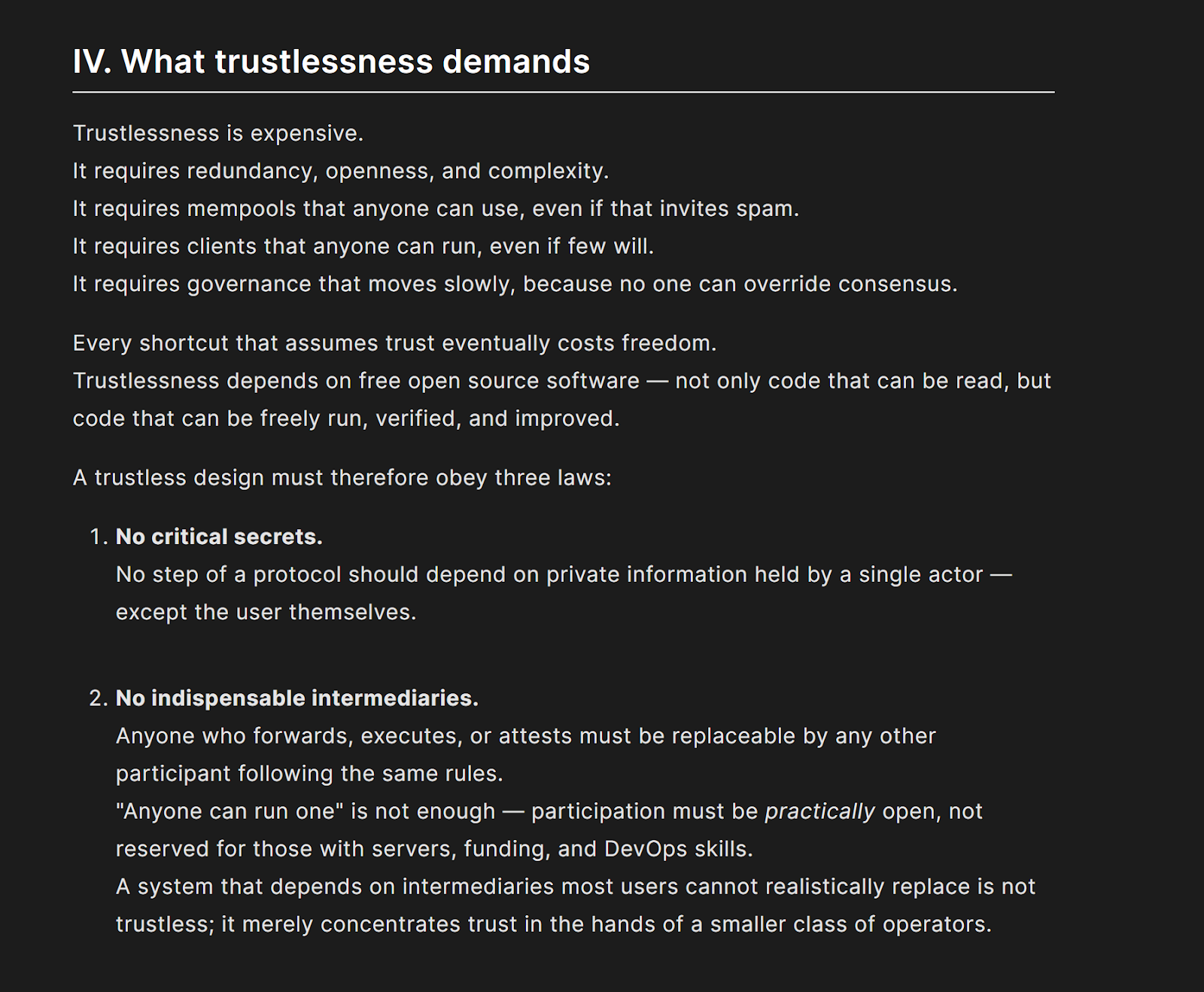

One of the most important parts of this, and something Vitalik Buterin has also been touching on recently with his trustless manifesto, is that we need to start talking seriously about how trustless our systems actually are.

A trustless system must be open, transparent, and verifiable. Anyone should be able to audit the code. Anyone should be able to verify transactions. The rules should be visible in advance and enforced mechanically.

Mathematics does not care who you are. It does not know your race, your nationality, your gender, your politics, or your social status. It does not label you. It does not discriminate. You cannot create inequality inside a system that does not track the attributes required to discriminate. This is where the conversation needs to go back to, in my opinion.

Instead of focusing almost entirely on speculation, which is fun and obviously very engaging to talk about on social media, we should be paying more attention to what these systems actually enable. In countries with hyperinflation, authoritarian governments, or collapsing institutions, the ability to store value in Bitcoin or stablecoins and to move those assets freely is far more important than whether the price of some coin is up or down double digits on any given day.

– – – – – – – – – – – – – – – – –

– Stay updated on THORChain –

– – – – – – – – – – – – – – – – –

Swap now 👉 swap.thorchain.org

Official website 👉 https://thorchain.org/

🔽 Follow THORChain 🔽

X / LinkedIn / Reddit

TikTok /IG / FB / Blog

🔽 Join the community 🔽

TG / Discord / Discord (DEV)

– – – – – – – – – – – – – – – – –