SwapKit - Powering Cross-Chain Wallets and Apps

Integrating a cross-chain protocol is rarely simple.

For wallets, apps, and infrastructure providers, supporting native swaps across multiple chains means dealing with constant upgrades, edge cases, routing logic, transaction building, security assumptions, and ongoing maintenance. Each new chain or liquidity source adds another layer of complexity.

Now imagine having to do this while keeping a clean user experience, supporting multiple wallets, handling transaction tracking, and staying compliant.

👉 This is where SwapKit enters the picture.

SwapKit abstracts away the complexity of integrating new routes and cross-chain logic, allowing wallet and dApp Devs to access cross-chain swaps with just a few lines of code. And all of this is made possible through their API and SDK.

This has made SwapKit one of the key drivers behind THORChain’s growth, enabling native integration into major wallets and applications such as Ledger, Trust Wallet, OKX Wallet and BitGet Wallet.

It’s time for a spotlight. ⤵️

⚙️ How Does SwapKit Work?

At its core, SwapKit provides a composable API and SDK that gives developers access to cross-chain swaps without having to manage multiple integrations themselves.The developers interact with a single, unified interface while SwapKit handles provider complexity and maintenance, routing logic, transaction building, gas estimation, approvals and cross-chain transaction tracking behind the scenes.

For cross-chain swaps, SwapKit routes trades through native cross-chain liquidity providers such as THORChain, Maya Protocol, Chainflip, and NEAR Intents. For single-chain swaps, it relies on in-chain DEX aggregators like 1inch or Jupiter. These two layers can also be combined, allowing swaps that move across chains and then route into specific assets on the destination chain.

From a user perspective, the experience remains simple. A single signature is required, and users only need gas on the originating chain. From there, SwapKit takes care of the entire execution flow, whether the swap is single-chain, cross-chain, or a combination of both.

From a developer perspective, SwapKit abstracts away the heavy lifting while remaining highly configurable. Integrators can easily fine-tune parameters, choose which routes and providers to enable or disable, and control execution preferences without rewriting logic. This abstraction covers:

- Native cross-chain swaps across multiple liquidity providers

- Single-chain DEX aggregation

- Transaction construction across UTXO and account-based chains

- Swap tracking and execution monitoring

- Address screening and AML checks before transactions are signed

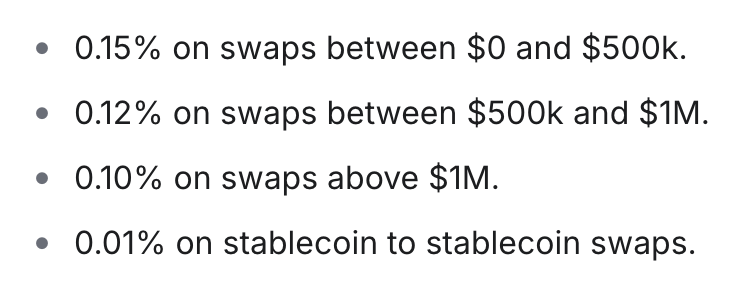

SwapKit applies a small service fee on swap volume, using a tiered structure that becomes more competitive as trade size increases. Fees decrease for larger swaps and are particularly low for stablecoin-to-stablecoin trades, ensuring the solution remains attractive for both retail users and high-volume flows.

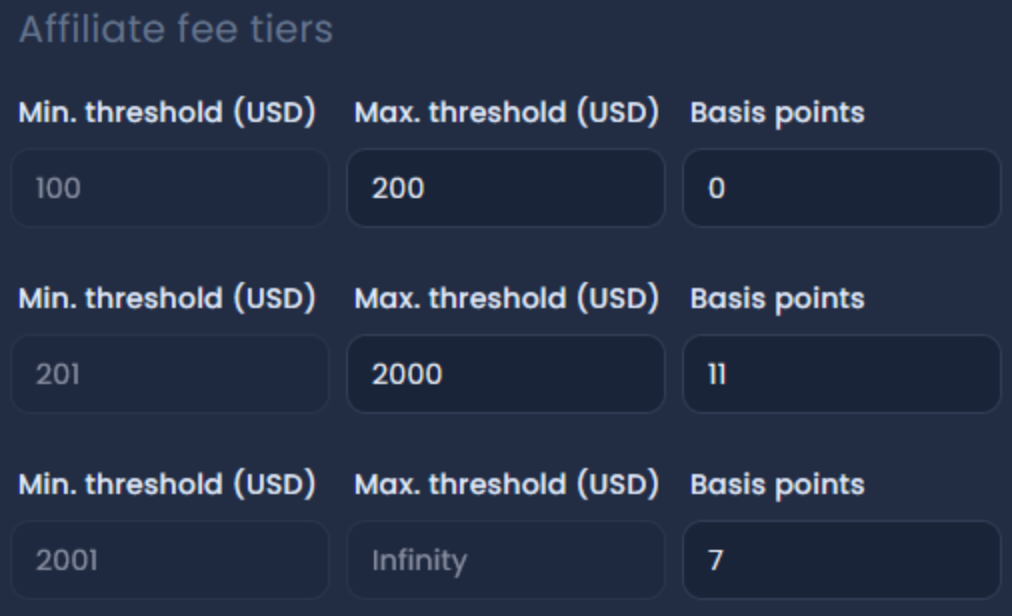

👉 More importantly, SwapKit enables monetisation. Wallets and applications can earn affiliate fees on every swap routed through their integration, turning cross-chain swaps from a pure feature into a sustainable revenue stream.

The result is an infrastructure layer that stays up to date as providers and routes evolve, while integrators can focus on what matters most: building user-facing products, growing their user base, and generating revenue.

📊 Key Figures

SwapKit’s traction highlights the strong demand for simple access to native cross-chain swaps.

Today, SwapKit supports more than 34 integrations across wallets, exchanges, and infrastructure providers. These include well-known frontends such as Ledger, OKX, Bitget, and Trust Wallet, as well as routing and infrastructure providers like LiFi, which in turn powers wallets such as Phantom and MetaMask.

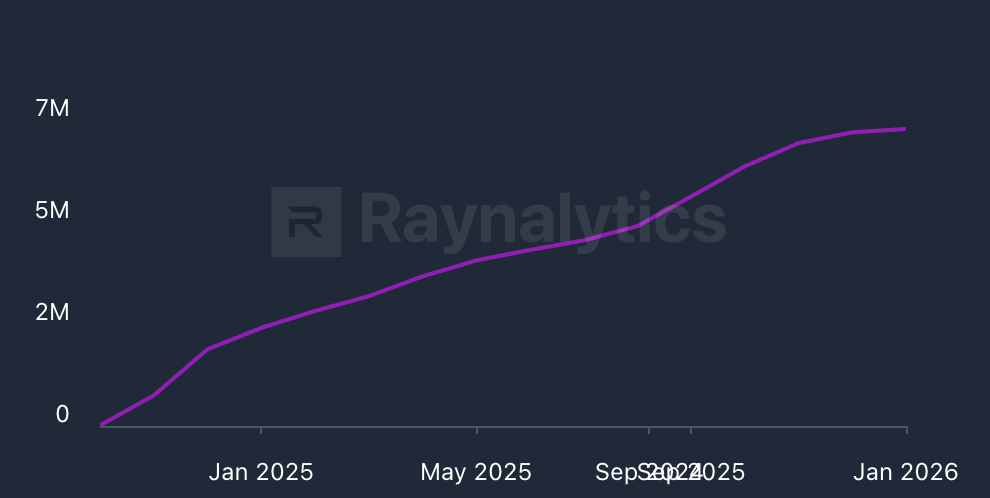

And thanks to its built-in monetisation, wallets and applications can generate fees directly from swaps, making SwapKit an obvious integration choice. As one example, Ledger alone has generated roughly $7 million in affiliate fees on THORChain through SwapKit in around a year and a half.

This adoption translates into meaningful onchain activity. More than 100,000 wallets have interacted with SwapKit, with over $1.59 billion in volume processed and approximately 480,000 transactions executed in Q4 2025 alone.

🧠 Why SwapKit Matters for THORChain

SwapKit plays a unique role in the THORChain ecosystem.

In many ways, it acts as a business development arm for THORChain. Instead of trying to convince users to adopt a new interface, SwapKit brings THORChain directly into the wallets and applications they already use.

👉 This unlocks users who would never naturally seek out THORChain on their own. More access leads to more swaps. More swaps lead to more volume. And more volume ultimately leads to more fees.

It is worth noting that SwapKit is not exclusive to THORChain. However, this should not be seen as a drawback. Like any infrastructure business, SwapKit must remain competitive, and supporting multiple providers is often a prerequisite for securing integrations. Those integrations, in turn, open new distribution channels for THORChain.

This dynamic also places healthy pressure on THORChain itself to remain competitive, which it does particularly well for large swaps, without relying on subsidies or artificial incentives.

👉 In short, by supporting multiple providers, SwapKit becomes easier to integrate, and by being easy to integrate, it makes THORChain easier to access. The incentives remain aligned.

👀 2026 Outlook

SwapKit has solidified its product, infrastructure and positioning in the cross-chain stack by supporting most of the assets in the Top100 by market cap. In 2026, the focus can expand on more novel offerings to improve swap rate and broaden its offering to attract new kinds of integrations.

Integrations remain a central part of this strategy. SwapKit will continue onboarding new wallets and applications across the ecosystem, reinforcing its role as a core piece of cross-chain infrastructure.

💭 Conclusion

SwapKit is a key infrastructure player in the THORChain ecosystem. It operates as a route-agnostic infrastructure business, investing in integration, compliance, and partnerships so that THORChain can scale far beyond its native interfaces.

Thanks to SwapKit’s efforts, THORChain is seamlessly embedded into wallets and applications that collectively generate hundreds of millions of dollars in volume and substantial protocol fees.

– – – – – – – – – – – – – – – – –

– Stay updated on THORChain –

– – – – – – – – – – – – – – – – –

Swap now 👉 swap.thorchain.org

Official website 👉 https://thorchain.org/

🔽 Follow THORChain 🔽

X / LinkedIn / Reddit

TikTok /IG / FB / Blog

🔽 Join the community 🔽

TG / Discord / Discord (DEV)

– – – – – – – – – – – – – – – – –