THORChain Q1 2025 Report & Q2 Roadmap

THORChain Q1 2025 Report and Roadmap

Q1 2025 Report

1 January 2025 — 31 March 2025

Q1’24 Report | Q2’24 Report | Q3’24 Report | Q4’24 Report

Summary

In Q1 2025, THORChain processed $19.62 billion in total USD volume, with a peak daily volume of $1.49 billion. Liquidity on the network decreased from $329 million to $127 million, while liquidity providers earned $14.41 million in fees, with 91.36% of earnings derived from swap fees and 8.64% from block rewards. The top swap routes by volume were BTC, ETH, and RUNE. Affiliate participation remained strong, with notable interfaces including Trust Wallet, THORSwap, and Asgardex driving significant volume. Major protocol updates included the integration of the Base chain, the sunset of THORFi lending and savers, and foundational enhancements such as CosmWasm support, Token Factory, and the removal of Admin Mimir. Looking ahead, Q2 will focus on new chain integrations (e.g. Solana, XRP) after EdDSA support, the launch of the RUJI app layer, and delivery of the TCY claims process following the THORFi unwind.

A Look at Q1 2025 Metrics

Quarterly Dashboard |Thorcharts |Thorchain.net | RUNE Tools

- Total USD Volume: $19.62b

- Highest 24h Volume: $1.49b

- Change in Total Liquidity: $329m to $127m

- Swap Fees Collected: $14.41m

- Affiliate Earnings: $7.91m

- LP Earnings Breakdown: 91.36% Liquidity Fees — 8.64% Block Rewards

Top 5 Swap Routes by USD Volume

- BTC <> ETH — $5,443,927,387

- BTC <> RUNE — $4,393,425,914

- ETH <> RUNE — $1,724,748,415

- ETH.USDT <> RUNE — $1,029,787,001

- BTC <> ETH.USDT — $969,044,257

Top 5 Swap Routes by Liquidity Fees (USD)

- BTC <> ETH — $4,863,308

- BTC <> RUNE — $3,580,708

- RUNE <> ETH — $1,978,074

- ETH.USDT <> RUNE — $1,015,706

- BTC <> USDT — $905,123

Top Affiliate THORNames by USD volume

- “ti” — $1,265,430,278 in 71,268 swaps

- “td” — $275,023,577 in 47,481 swaps

- “-_” — $792,808,070 in 16,470 swaps

- “t” — $624,080,903 in 6,584 swaps

- “wr” — $587,303,469 in 6,584 swaps

- “okw” — $373,032,171 in 5,700 swaps

- “dx” — $2358544008 in 5,210 swaps

- “lifi” — $19,372,868 in 5,083 swaps

- “bgw” — $240,899,737 in 4,337 swaps

- “ll” — $333,958,582 in 3,837 swaps

- “tb” $357,825,558 in 3,069 swaps

- “ro” — $28,907,737 in 1,298 swaps

- “ss” — $203,403,777 in 2,441 swaps

- “ej” — $23,570,097 in 2,629 swaps

What’s new to THORChain in Q1 2025?

Base Chain Integration

Base was added to THORChain. Available assets include ETH, USDC, and cbBTC. Other assets are whitelisted for pool creation. This marks the first new chain to be added since Binance Smart Chain.

Lending & Savers Unwind

Lending and Savers features have been sunset. Read the timeline of events leading to the sunset here.

The community fielded many proposals on how to address the THORFi liabilities. Proposal 6 passed governance. Details for TCY and Prop 6 can be found here, which will be implemented in Q2.

Users affected by the THORFi sunset will have to claim their TCY after it is implemented, which is not yet available. Watch THORChain on Medium and on X to get instructions on how to claim TCY once it is live. There will be no rush to claim TCY. Beware scams and fake claim websites.

- TCY Claim Amount Checker (claims are not live yet)

- GRC Video

- RSS Feed for Spaces with Q&A

Removal of Block Rewards

Nodes voted to deprecate block rewards. Now, 100% of all fees paid to liquidity providers and node operators are generated from swap fees from the network. The Reserve balance has been steady since the removal of block rewards and all rewards come from sustainable non-inflationary sources.

New Nodes Per Churn Increase

The validators voted to change the number of new nodes that can be added to the active set per churn from 2 to 4. This means that the network will allow up to 4 more nodes to join than the amount of nodes that are leaving per churn.

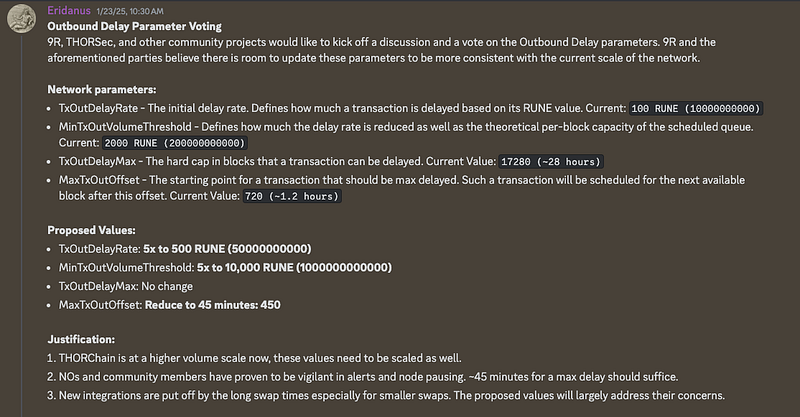

Outbound Delay Changes

A vote was carried out to soften the outbound delay parameters. This resulted in shorter swap times due to the outbound delay.

Token Factory

PR

Cosmos Token Factory was added to THORChain, allowing the creation of new tokens on THORChain network. This is necessary for the launch of RUJI to allow THORChain to have native representations of new assets on the chain.

CosmWasm & ExecMemo

THORChain now supports CosmWasm smart contracts, which is necessary to support the THORChain App Layer. CosmWasm is the standard smart contract environment for Cosmos. RUJI will be delivered using the CosmWasm stack. This change also allows the execution of a CosmWasm smart contract with parameters from an L1 transaction.

Token Switch

Token Switch was re-added to THORChain to allow the RUJI network to switch their token from their native version to being a token on THORChain.

Quote Endpoint Slippage Parameter

A new parameter was added to the quote endpoint for more intelligent slippage protection. The previous implementation applied the slippage amount to the inbound amount, leading to failed quotes on small amounts due to gas fees not being accounted for. This new “liquidity_tolerance_bps” field applies the slippage tolerance to the quoted amount out, aligning more to the definition of slippage and creating a better integrations developer experience.

Remove Admin Mimir

Admin Mimir has been completely removed from the network. The nodes have complete control over the governance of the network. Most parameters require a 2/3rds consensus to change. Some operational controls are allowed by a minority of nodes (minimum three votes) for security and maintenance, such as pausing chain observations, trading, or signing.

RUJI Portfolio Page Live

Rujira launched the Portfolio page, allowing users to connect multiple wallets — including Keplr, Leap, Brave, OKX, Metamask, Rabby, Ctrl & Vultisig — and view all on-chain activity in a unified view. Try it today connecting all your wallets in one portfolio page on RUJI Portfolio.

RUJI Trade, Pools, and Perps Audits Completed

Security audits for RUJI Trade, Pools, and Perps have been successfully completed. The Perps module audit was conducted by FYEO. Details are available at FYEO. A full list of contracts, audit reports, and checksums can be accessed in the Rujira GitLab repository.

RUJI Swap Soft Launch

RUJI Swap was soft-launched, enabling direct swaps with THORChain base layer pools. RUJI Swap will evolve beyond base layer pools as CosmWasm contracts are deployed and secured assets are added to app layer pools. Users can explore the platform at RUJI Swap.

Roadmap — What to expect in Q2

A number of new features are being worked on by Nine Realms, Strangelove, and other independent contributors. Some may change in design or scope before being released to THORChain mainnet.

EdDSA Signing

THORChain was built using ECDSA vaults. THORChain needs to add EdDSA to add new chains such as Solana, Cardano, TON, and SUI.

New Chain Integrations

New chain integrations are being led by Strangelove. The teams are focusing efforts on SOL, TRON, TON, XRP. Other chains are in the pipe. THORNode operators should signal chains they would support being added and also dissent from new chains they may disagree with adding.

TCY and THORFi Recovery

THORFi recovery is a top priority for the teams. The Maya team is working on delivering the Prop6 and TCY implementation as part of the THORFi Unwind. A claim app for TCY will be added to the main thorchain.org website.

Bifrost P2P Refactor

Strangelove is leading a refactor of Bifrost to cut down on bloat. The goal is to reduce block times from 6 seconds to 1 second. Optimizations are being made to make the external chain observation layer more efficient.

RUJI Merge and TGE

As the merge contract goes live, holders of $LVN, $FUZN,, $NAMI, $NSTK, $WINK, $RKUJI and $KUJI can lock their tokens in the contract and convert to $RUJI. More information on conversion ratios and decay function will follow as the merge page opens up for deposits.

RUJI Staking and Revenue Collector

Before RUJI TGE, the staking and revenue contracts will be deployed on mainnet so RUJI holders can stake their RUJI tokens or LP tokens to earn their share of the net fees generated by the app layer after paying THORChain for network security.

RUJI Product Rollout

RUJI will be delivering the first set of DeFi products in Q2, including RUJI Trade, Pools and most likely Perps. These will be the first independent products developed on top of THORChain, leveraging Secured Assets.

Operator Rotation Memo

A new memo was added to allow THORNode operators to rotate to a new operator address without having to unbond and create new infrastructure. This will simplify regular maintenance operations for large operators on the network.

Addressing Economic Security

The network is at its hard cap and will not currently accept new liquidity deposits. The devs are planning on creating a new mimir to adjust the amount of economic security in order to allow THORChain to grow, especially with the addition of new chains and a new App Layer. The new approach to economic security will allow bounded growth to maintain THORChain’s posture for economic security without creating unnecessary headwinds for the ecosystem.

Ethereum Router V5

Upgrades to the Ethereum Router for transferOutAndCall, as well as adding support for Batched Outbounds.

Where to get more information about THORChain?

- Twitter Spaces — subscribe on RSS or wherever you get your podcasts

- THORChain University — educational content, monthly posts, & discord server

- THORChain University Updates — monthly update articles

- GrassRoots Crypto — update videos

Community

To keep up to date, please monitor community channels, particularly Telegram and X:

Website | Documentation | X | Telegram Community | Telegram Alerts | Community Discord | Developer Discord | Explorer | RuneScan | Reddit | Gitlab | Medium | Linktree | Thorcharts | RUNE Tools